Localized Pricing Guide For SaaS Growth

Set SaaS prices by purchasing power, local competition, and payment habits to boost conversions, ARPU, and sustainable international growth.

Localized Pricing Guide For SaaS Growth

Localized pricing can help SaaS businesses grow faster by aligning prices with regional purchasing power, competition, and customer behavior. Instead of simply converting prices based on exchange rates, this strategy adjusts pricing to fit local economic conditions and customer expectations.

Here’s why it matters:

- 11% monthly growth: Companies using localized pricing grow faster than those relying on currency conversion (9%).

- Higher conversions: Localized pricing boosts international conversion rates by up to 4.7x in emerging markets.

- Revenue optimization: Properly localized pricing can increase revenue in high-value markets while making products affordable in lower-income regions.

Quick tips for success:

- Use Purchasing Power Parity (PPP) to set fair prices for each region.

- Research local competition and customer habits to fine-tune pricing.

- Offer region-specific payment options (e.g., UPI in India, Pix in Brazil).

- Regularly review and adjust prices based on market trends and customer feedback.

Localized pricing is a powerful tool for scaling SaaS globally, improving both revenue and customer satisfaction.

Mastering Pricing Localization: How SaaS Teams Win International Markets

sbb-itb-0499eb9

The Basics of SaaS Price Localization

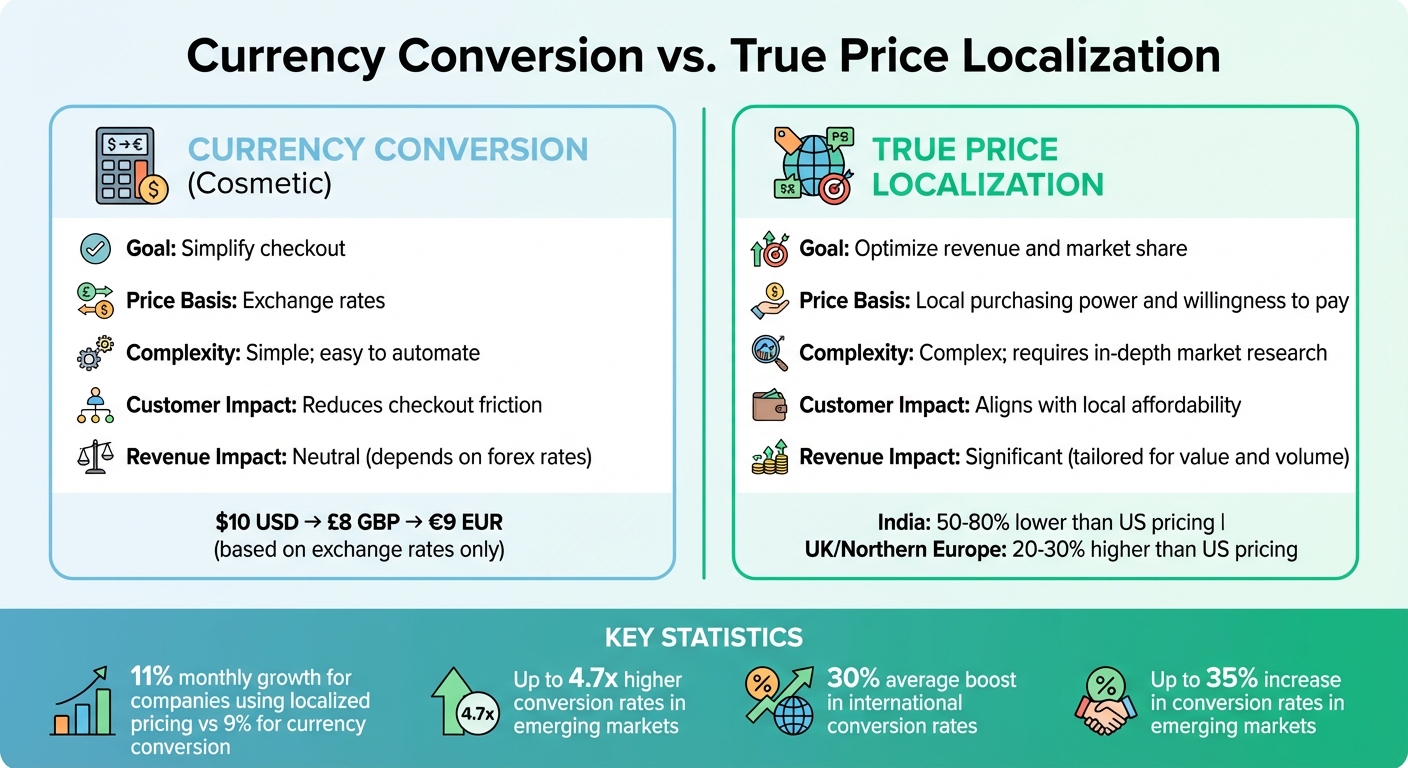

Currency Conversion vs True Price Localization for SaaS

Localized pricing is all about adjusting your SaaS rates to align with the economic conditions, competition, and customer expectations in each region. Instead of simply converting $10/month to £8/month based on exchange rates, true localization digs deeper. It sets prices that reflect what people in those regions can realistically afford and are willing to pay, creating a better fit for local markets.

Take Duolingo, for example. They charge more in Spain and France than in the United States because learning English carries greater professional and academic value there. On the flip side, Flo reduced its prices significantly in Brazil to match local incomes. This move helped Brazil become its third-largest market and fueled an 80% growth in non-English speaking regions within just a year.

The numbers back up the importance of getting localization right. Properly localized pricing can increase conversion rates by up to 35% in emerging markets and help you capture 40% more market share in new regions.

How Localized Pricing Affects Revenue

Localized pricing isn't just about fairness; it's about maximizing revenue while keeping your product accessible. Different regions have vastly different levels of willingness to pay. For instance, customers in the UK and Northern Europe often pay 20–30% more than their U.S. counterparts due to less market saturation. Meanwhile, in Southeast Asia, customers may only be willing to pay 60–70% less because of lower purchasing power.

If you rely solely on currency conversion, you risk leaving money on the table in high-value markets or pricing yourself out of reach in emerging ones.

"Currency conversion without localization ignores fundamental differences in market conditions, purchasing power, and competitive landscapes. It's essentially asking international customers to shoulder the burden of your domestic pricing logic." - Maria Chen, Chief Strategy Officer, SaasBound

Adobe’s experience in Australia is a cautionary tale. When they launched Creative Cloud there, the price was so steep that customers found it cheaper to fly to the U.S., buy the software, and return home than to purchase it locally. This misstep not only hurt their bottom line but also eroded customer trust.

Localized Pricing vs. Currency Conversion

It’s crucial to understand the difference between basic currency conversion and true price localization. Here’s a quick comparison:

| Feature | Currency Conversion (Cosmetic) | True Price Localization |

|---|---|---|

| Goal | Simplify checkout | Optimize revenue and market share |

| Price Basis | Exchange rates | Local purchasing power and willingness to pay |

| Complexity | Simple; easy to automate | Complex; requires in-depth market research |

| Customer Impact | Reduces checkout friction | Aligns with local affordability |

| Revenue Impact | Neutral (depends on forex rates) | Significant (tailored for value and volume) |

Currency conversion is straightforward - it takes a $10 price and converts it to £8 or €9 based on current exchange rates. While this approach is easy to implement, it assumes all markets are the same. This can result in prices that are too high for regions like India or Brazil, or too low for Western Europe, where customers might be willing to pay more.

True localization, however, requires more effort. It involves studying price sensitivity, analyzing local competition, and considering purchasing power parity. For instance, Apple suggests pricing in India be 21% lower than in the U.S., but many apps go even further, pricing 50–80% lower to meet local demand. In markets like Brazil and India, reducing prices by 40–60% compared to simple currency conversion often makes the difference between success and failure.

"We've found that progressive localization delivers the best results. We start with conversion plus round pricing, then adjust based on conversion data over 6–12 months." - Thomas Rivera, VP of International Growth, CloudStack

Customer perception also matters. When customers see prices in a foreign currency, they often have to do mental math to figure out the real cost. Even if they understand exchange rates, seeing €20 convert to $30 can feel like a 50% price hike. This mental friction, combined with fears of hidden exchange fees, can hurt conversions.

This framework sets the stage for crafting a pricing strategy that resonates with your global audience.

What to Consider When Building Your Localization Strategy

Before diving into localized pricing, it’s crucial to understand the unique dynamics of each market. This includes evaluating economic conditions, competitive landscapes, and legal requirements. These foundational steps will significantly impact whether your pricing strategy succeeds or misses the mark.

Regional Purchasing Power and Affordability

A $50/month price tag in the U.S. might feel reasonable, but in countries like India or Brazil, that same amount could translate to over $200 when adjusted for local purchasing power. This is where Purchasing Power Parity (PPP) becomes a game-changer. PPP goes beyond currency exchange rates, showing what money can actually buy within a local economy.

The difference between nominal and PPP-adjusted figures can be striking. For example, India’s nominal GDP per capita is about 3% of that in the U.S., but this figure jumps to nearly 20% when adjusted for PPP. If you rely solely on currency conversion for pricing, you risk alienating entire markets.

"When we analyzed SaaS companies expanding internationally, those that adjusted their pricing based on purchasing power parity saw 4.7x higher conversion rates in emerging markets." - Patrick Campbell, CEO, ProfitWell

Emerging markets like Brazil or India often require price reductions of 40–60% to attract customers, while mature markets such as the UK or Germany tend to align more closely with U.S. pricing. Even within PPP-adjusted models, customers’ willingness to pay can still vary by 20–40%, depending on how they perceive the value of your product. For instance, a language learning app might be viewed as a casual tool in the U.S., but in Europe, it could be seen as essential for career growth - justifying a higher price point.

After factoring in purchasing power, take the time to study local competitors and customer behavior to fine-tune your strategy.

Market Competition and Customer Behavior

Once affordability is addressed, the next step is understanding how local competition and customer preferences influence pricing. Local competitors often design SaaS pricing strategies tailored to their specific markets. Simply converting your U.S. prices into local currencies can leave your product overpriced, even if it offers greater value. On the flip side, in less saturated markets - such as Western Europe for certain developer tools - customers may be willing to pay 20–30% more than their U.S. counterparts.

"The ideal price in a market isn't determined by exchange rates, but by what customers in that market are willing to pay." - Tomasz Tunguz, Venture Capitalist, Redpoint

Customer habits also vary widely across regions. For example, Japanese buyers often prefer long-term contracts that signal reliability, while Brazilian customers lean toward month-to-month flexibility. Payment preferences matter, too. Offering local methods like PIX in Brazil or UPI in India can increase conversion rates by up to 40%. Even small details like pricing psychology can differ - some regions respond better to prices ending in .99, while others prefer rounded numbers.

Currency stability further complicates things. In Latin America, 67% of SaaS buyers prefer prices in USD over their local currency when purchasing from North American companies, as they perceive USD pricing to be more stable and premium. This challenges the assumption that everyone prefers local currency pricing.

Tax and Legal Requirements

Taxes can make pricing more complex. Different regions have unique tax systems - VAT in Europe, GST in Australia and India, and various state taxes in the U.S. - all of which affect your margins and the final price. Deciding whether to display prices with or without taxes depends on local norms and expectations.

"The question isn't just what price to display, but how to account for local tax requirements in your pricing structure." - Elena Baxter, Tax Director, SaaS Global Advisors

Scaling internationally may also require setting up legal entities in different countries to handle data segregation, local accounting, and compliance with statutory reporting. Additionally, some regions enforce specific payment security measures, like Strong Customer Authentication (SCA) or 3D Secure, which must be integrated into your checkout process without causing unnecessary friction.

To simplify tax compliance, many companies turn to a Merchant of Record (MoR) or specialized billing platforms. These tools automate tax calculations, collections, and remittance, allowing you to focus on refining your pricing strategy while ensuring compliance is managed seamlessly.

How to Implement Localized Pricing

Once you’ve identified your target markets, the next step is putting your pricing strategy into motion. This involves testing price points, setting up payment systems, and rolling out changes in a way that minimizes risk while maximizing insights.

Running Market Research and Price Tests

Start by pinpointing which markets deserve your attention. Focus on your top 10–20 markets based on downloads, and compare conversion rates (download-to-purchase) with average revenue per user (ARPU). If engagement and retention are strong but conversions lag, it’s likely a pricing issue rather than a product-market fit problem.

Before testing internationally, refine pricing in your primary market. Run “big swing” tests - like comparing $39 to $69 - to gather clear, actionable data. Small adjustments often lead to ambiguous results. Once your home market pricing is optimized, create a pricing index by analyzing around 10 competitors, both global and local. Use a VPN to access local app stores directly, as third-party tools often provide outdated information.

The Van Westendorp Pricing Model is a valuable tool for identifying acceptable price ranges. Ask potential customers in each target region four questions to understand their perception of pricing: when a price feels too cheap (low quality), a bargain, expensive but acceptable, and too expensive. This approach helps define a realistic pricing window.

"If your conversion rate in India is five times lower than in Canada, Australia, or US, well, there's some mismatch, right?" - Jacob Rushfinn, Founder, Rushfinn Consulting

Don’t rely solely on app store defaults - Apple and Google base their pricing recommendations on exchange rates and taxes, not local demand or perceived value. A great example comes from 2024, when the period tracking app Flo adjusted pricing for non-English-speaking markets, leading to 80% growth in those regions compared to 35% in English-speaking ones. Brazil, in particular, became their third-largest market after they lowered prices, with reduced ad costs maintaining profitability.

Once your pricing tests are underway, the next priority is ensuring your technical setup meets regional needs.

Setting Up Payment Methods and Currency Display

A proper technical setup is just as critical as selecting the right price. There are two main approaches to currency localization: cosmetic localization, which converts your base price using exchange rates, and true localization, which adjusts prices based on local purchasing power and market conditions. Cosmetic localization is simpler and works well for smaller teams or MVPs, while true localization is better for competitive markets.

Offering local payment options can significantly boost conversions. Examples include iDEAL in the Netherlands (used for 70% of e-commerce transactions), Pix in Brazil, and UPI in India. Businesses that provide region-specific payment methods often see a 40% increase in conversion rates. Additionally, implementing multi-currency pricing can drive a 30% lift in international conversions.

When displaying prices, follow ISO 4217 standards for currency formatting. For instance, Japanese Yen (JPY) doesn’t use decimals (¥5,000), while Bahraini Dinar (BHD) uses three (د.ب18.750). Tools like JavaScript’s Intl.NumberFormat API can help ensure prices are formatted correctly for each region - €49,99 in Germany versus $49.99 in the U.S.. To avoid security risks, handle currency conversions server-side, and use proper database architecture and caching to maintain accuracy and performance.

After configuring your payment systems, roll out pricing changes gradually to validate your strategy.

Rolling Out and Tracking Your Pricing Changes

With your research and technical setup complete, launch localized pricing incrementally. Start with one or two high-potential markets instead of attempting a global rollout. Focus on regions with high traffic but low conversion rates - these “conversion gaps” are where you’ll find the most opportunity. For example, in May 2021, Twitch introduced localized subscription pricing to reduce barriers in regions with lower purchasing power. This initiative, supported by Pipeline founder Stephen Ellis, also increased revenue for content creators.

"Begin your pricing localization discussions with positioning. Talking about whether you want to be a premium product or mass-market solution upfront makes every other pricing localization decision easier." - Cristina Poindexter, former Product Marketing Lead, Headspace

Avoid creating separate product IDs for every region (e.g., Pro_Plan_USD, Pro_Plan_EUR). Instead, use a single product ID tied to multiple currency-specific price points. This simplifies global reporting and maintains data integrity. Successful implementation requires coordination across teams: Marketing (positioning), Product (location-based displays), Finance (multi-currency invoicing), and Sales (monitoring MRR changes due to exchange rates).

Test your implementation thoroughly. Use location-specific email formats (e.g., test+location_FR@example.com) to verify how prices appear at checkout. To minimize friction during price increases, consider grandfathering existing customers into their original pricing rather than forcing them to migrate. Always clarify whether displayed prices include local currency or if conversion will occur at the customer’s bank.

After launch, monitor key performance indicators like regional conversion rates, ARPU shifts, and customer feedback. With the global B2C cross-border e-commerce market projected to hit $7.9 trillion by 2030, getting your localization strategy right is crucial for long-term success.

Improving Your Localized Pricing Over Time

Once you've launched localized pricing, the work doesn't stop there. To keep your strategy effective, you'll need to continuously evaluate how it's performing, stay responsive to market changes, and listen closely to customer feedback about value and affordability.

Measuring Performance by Region

Keep an eye on key metrics like conversion rates, churn, and ARPU (Average Revenue Per User) for each market. If engagement and retention look solid but conversions are lagging, the issue likely lies in pricing rather than product-market fit. A critical metric to monitor is Lifetime Value (LTV) - while lower prices might drive short-term growth, sustainable success depends on long-term profitability.

Tracking MRR (Monthly Recurring Revenue) in USD can also help you understand the impact of exchange rate fluctuations. Companies that take localized pricing seriously often see an average 30% boost in international conversion rates. Interestingly, willingness to pay for the same SaaS product can differ by 20-40% across markets, even when Purchasing Power Parity is factored in.

"The ideal price in a market isn't determined by exchange rates, but by what customers in that market are willing to pay." - Tomasz Tunguz, Venture Capitalist, Redpoint

These insights are invaluable for making timely pricing adjustments as markets evolve.

Adjusting Prices Based on Market Shifts

Revisit your international pricing every six months to stay aligned with market trends. Economic changes, such as inflation or currency devaluation, often call for pricing updates. A great example is YouTube Premium, which lowered subscription prices in Argentina and India in 2024. This move led to a 30% jump in trial starts and improved 90-day retention rates.

To fine-tune pricing, use competitor data and real-time regional insights. A simple way to gather this is by using a VPN to check local app store pricing. For instance, in the UK, apps often price about 10% lower than U.S. rates to remain competitive, even though Apple's default pricing suggests a 26% higher rate. In India, successful apps frequently price 50-80% lower than in the U.S., well beyond the 21% discount typically recommended by app stores.

When increasing prices, consider offering legacy pricing to existing users. The cost of migrating customers to new rates can often outweigh the potential revenue gain. To test changes, try geo-fenced experiments in a single region, like Australia, for 30 days. This approach allows you to measure trial starts and retention before rolling out updates globally.

Using Customer Feedback to Refine Pricing

Numbers tell part of the story, but customer feedback can reveal even more about how to adjust pricing effectively. Sales and support teams that interact directly with customers are great sources for understanding perceptions of fairness, preferences for monthly versus annual billing, and reactions to discounts. Use structured feedback tools to identify price points and acceptable ranges based on perceived value.

Regional preferences also play a role in how pricing is presented. For example, some markets prefer rounded numbers (like $50), while others expect prices ending in ".99" (like $49.99). In regions like Latin America, 67% of SaaS buyers may actually favor USD pricing over local currency, as it's seen as more premium and stable. By asking customers about their preferences and watching their behavior at checkout, you can fine-tune your pricing strategy for continued growth.

Conclusion: Growing Your SaaS with Localized Pricing

Localized pricing helps align your product's value with what customers in different regions can afford. This approach can lead to up to 30% higher growth while improving your bottom line by 12.7–16% with just a 1% improvement in monetization.

Start with the basics: show prices in local currencies and translate your pricing page for key markets. Once your domestic pricing is fine-tuned, move to true localization - adjusting prices based on local purchasing power and market competition. Running bold price tests can reveal how each market reacts. These steps create a solid foundation for long-term growth and better alignment with your global audience.

From there, shift your focus to long-term success metrics like lifetime value (LTV) and retention instead of short-term conversion spikes. Companies that update pricing quarterly achieve 4x more ARPU growth over five years compared to those revising it annually. Keep a close eye on regional performance, listen to customer feedback, and adapt to market changes. For example, in 2025, app spending in Brazil grew by 31%, while Mexico saw 26% growth - proof that localized pricing can unlock new revenue opportunities.

Refine your base pricing, address conversion gaps in high-traffic regions, and expand your localization efforts. By consistently improving your pricing strategy, you can achieve sustainable global growth and take full advantage of the opportunities outlined in this guide.

FAQs

How do I choose the first countries for localized pricing?

When deciding where to focus localization efforts, begin with countries that show the most potential for boosting growth and revenue. Look for markets with strong SaaS adoption, existing customer traction, and pricing that doesn't align well with local expectations. For instance, Western Europe and certain parts of Asia often exhibit high demand and a readiness to adopt digital solutions.

Dive into your customer data to pinpoint regions with untapped potential. Adjusting pricing strategies in these areas can open the door to new revenue streams and lead to better conversion rates. Tailored approaches can make all the difference in markets where demand already exists but pricing strategies feel out of sync.

How do I set local prices using PPP without hurting revenue?

Adjusting your pricing based on Purchasing Power Parity (PPP) can help you cater to local markets without sacrificing revenue. By aligning your prices with regional economic conditions, you can make your products or services more accessible to international customers. This approach not only improves affordability for buyers but also supports better conversion rates globally - all while ensuring your business remains profitable.

Should I bill customers in USD or their local currency?

Billing customers in their local currency can make a big difference in how they perceive your business. It’s not just about convenience - it’s about trust. Research shows that localized pricing strategies can increase international conversion rates by an average of 30%. For SaaS companies aiming to expand globally, this approach isn’t just helpful - it’s a smart move to improve customer satisfaction and drive growth.

Built by Artisan Strategies

Here at Artisan Strategies we both help companies accelerate their own revenue and launch our own products to improve your daily life. Whether it's for productivity (Onsara for macOS) or simply a better dictionary in Chrome (Classic Dictionary 1913), we've built something for you.