Best Practices for Transitioning SaaS Growth In-House

How and when to bring SaaS growth in-house: readiness signals, team structure, tools, phased transition, knowledge transfer, and key metrics to track.

Best Practices for Transitioning SaaS Growth In-House

Transitioning SaaS growth in-house can help companies improve alignment, retain product expertise, and build long-term growth systems. However, it requires careful planning, clear metrics, and phased execution to avoid setbacks. Here's what you need to know:

- When to Transition: Companies with $1M–$5M ARR should consider moving growth in-house if product-market fit is stable and growth bottlenecks are clear. Budget for fixed costs like salaries and tools (~$250,000 annually) and ensure enough ongoing work to justify the investment.

- Key Metrics: Track CAC payback (<18 months), 90-day retention (>80%), and Net Revenue Retention (>100%) to measure success.

- Team Structure: Start with a senior growth generalist, then hire specialists (e.g., UX/UI Designer, Data Analyst) based on bottlenecks like acquisition or retention. Use small teams (3–6 people) for agility.

- Knowledge Transfer: Document past experiments, tools, and processes from external advisors. Pair documentation with hands-on training to avoid losing insights.

- Tools & Workflows: Use platforms like HubSpot (CRM), Mixpanel (analytics), and Google Optimize (testing). Establish repeatable workflows for experiments and growth sprints.

- Phased Transition: Start with small tests, gradually shift responsibilities, and use a hybrid model (outsourced + in-house) during the transition. Prepare rollback plans for unexpected issues.

- Continuous Improvement: Monitor metrics, refine strategies with data, and focus on retention to maximize long-term growth.

Quick Tip: Focus on solving your biggest growth bottleneck first - whether it’s acquisition, activation, or retention - before scaling your team or processes.

SaaS ICP Strategy: The "Enterprise Trap" Pivot to $1M ARR (Jonathan Festejo)

sbb-itb-0499eb9

How to Know If You're Ready to Move Growth In-House

External Advisors vs In-House Growth Teams: Cost, Speed, and Control Comparison

Before jumping into hiring, ask yourself this: do you truly have something worth scaling? Without solid product-market fit, even the best growth strategies can fall flat. If you're still trying to validate that fit, hiring a growth team could drain your resources without delivering results.

Your Annual Recurring Revenue (ARR) can help guide your decision. At $0–$1M ARR, focus on founder-led growth or generalists. Once you hit $1M–$5M ARR, it's time to establish functional teams as your go-to-market strategy becomes more predictable. Between $5M–$20M ARR, bringing in specialists like demand generation managers or account executives can boost efficiency and align with your growth goals.

Budget is just as important as revenue. Building an in-house team comes with fixed costs - salaries, benefits, recruitment, and tools. A basic setup can easily cost around $250,000 annually. To make this investment worthwhile, you need enough ongoing work to fully utilize your team. Otherwise, you're paying for downtime.

You're ready to move growth in-house when you can clearly pinpoint your biggest bottleneck - whether that's acquisition, activation, or monetization - and need someone to run daily experiments to address it. If your product requires deep technical expertise, complex funnel management, or seamless coordination between sales, product, and marketing, external advisors may not move fast enough. In these cases, an in-house team becomes essential. Once you determine you're ready, the next step is setting measurable goals to track your progress.

Set Clear Success Metrics

Defining success is critical. Before transitioning growth in-house, establish clear KPIs to measure whether the move is paying off. For early-stage SaaS companies, aim for a 90-day retention rate above 80% and a CAC (Customer Acquisition Cost) payback period under 18 months. As you scale, focus on achieving Net Revenue Retention (NRR) above 100%, which indicates you're growing revenue from your existing customer base.

Monitor these metrics before, during, and after the transition. It's normal to see some dips in the first 3–6 months as your team gets up to speed. Elena Verna, Head of Growth & Data at Dropbox, highlights that even seasoned growth leaders often need six to 12 months to fully grasp a company's unique challenges. Set realistic expectations with your executive team to avoid surprises during this ramp-up period.

Growth benchmarks also evolve as your ARR increases. Between $1M and $5M ARR, aim for 150–200% year-over-year growth. At $5M–$20M ARR, target 100–150%. Once you surpass $20M ARR, growth rates typically slow to 60–100%. If your current advisor setup isn't hitting these benchmarks, it's a warning sign - but it doesn't necessarily mean an in-house team is the solution.

With these metrics in place, you're better equipped to decide on the right team structure for your needs.

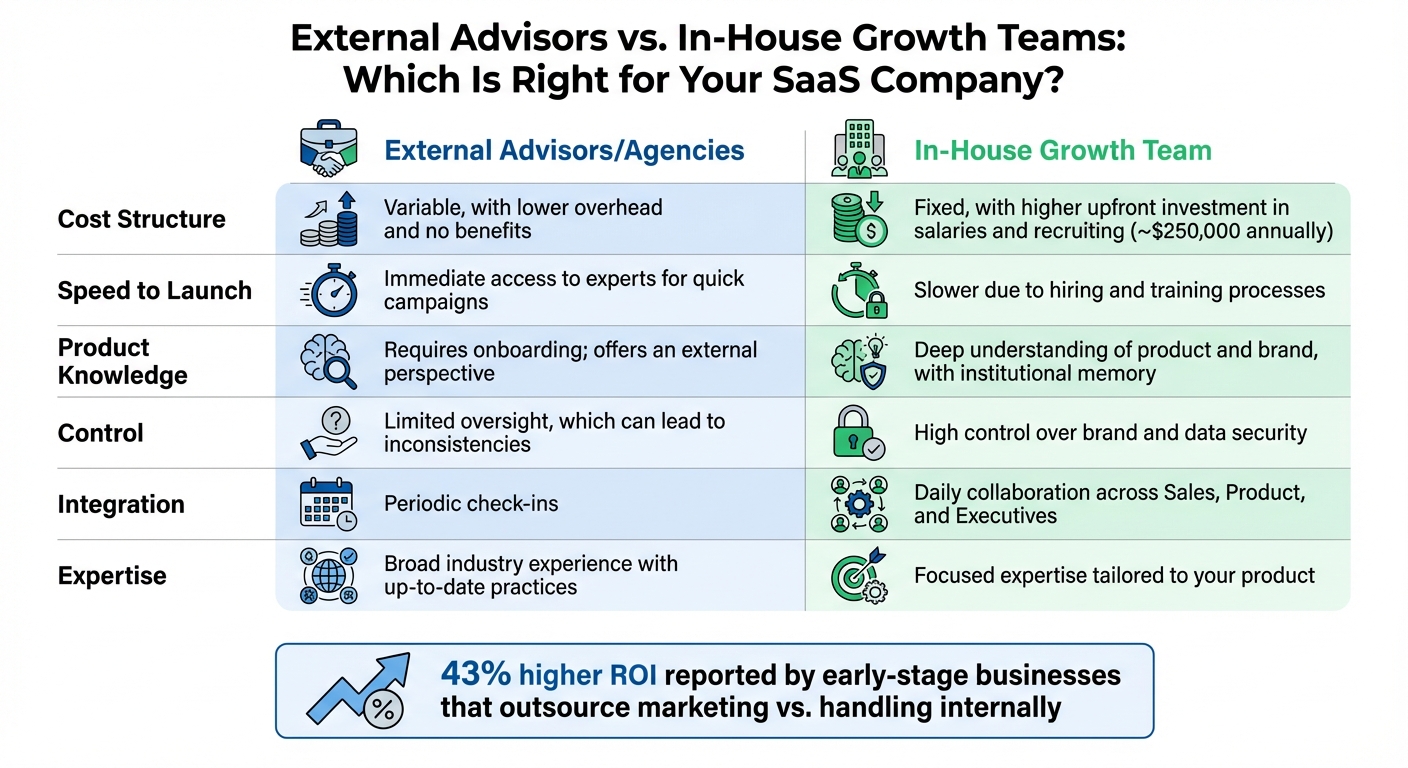

External Advisors vs. In-House Teams: What's the Difference?

Choosing between external advisors and an in-house team isn't about picking the "better" option. It's about finding the right fit for your stage and goals. External advisors offer quick access to expertise and faster campaign launches but might lack deep product knowledge and control. On the other hand, in-house teams take longer to build and come with higher fixed costs, but they provide stronger alignment with your brand and a deeper understanding of your product.

Here’s a comparison to help clarify the differences:

| Feature | External Advisors/Agencies | In-House Growth Team |

|---|---|---|

| Cost Structure | Variable, with lower overhead and no benefits | Fixed, with higher upfront investment in salaries and recruiting |

| Speed to Launch | Immediate access to experts for quick campaigns | Slower due to hiring and training processes |

| Product Knowledge | Requires onboarding; offers an external perspective | Deep understanding of product and brand, with institutional memory |

| Control | Limited oversight, which can lead to inconsistencies | High control over brand and data security |

| Integration | Periodic check-ins | Daily collaboration across Sales, Product, and Executives |

| Expertise | Broad industry experience with up-to-date practices | Focused expertise tailored to your product |

Many early-stage businesses that outsource marketing report about 43% higher ROI compared to handling everything internally. However, as your company grows and demands tighter integration between teams, the benefits of outsourcing can diminish. In some cases, a hybrid model works best - keeping core strategy in-house while outsourcing specialized tasks like paid media or technical SEO.

How to Build Your In-House Growth Team

Bringing growth efforts in-house requires more than just setting metrics - it’s about crafting a focused team that can deliver results. A small, dedicated team often outperforms a larger one by staying agile and aligned with clear goals.

Start by hiring a senior growth generalist. This person acts as the glue across all growth channels, managing the pace of experiments and ensuring data is effectively tracked and used. Think of this role as a Builder - someone who thrives on tactical execution and can create systems from scratch. Hold off on hiring a high-level growth leader until your generalist has laid the groundwork; even seasoned leaders need time to fully understand your company’s unique challenges.

Once your generalist is in place, prioritize additional hires based on your most pressing bottlenecks. For example, if conversion rates are low, a UX/UI Designer can improve activation and monetization. A Net Promoter Score (NPS) below 30 often signals that design or functionality needs immediate attention. If onboarding is a weak point, a Customer Success Manager can help users find value quickly and drive upsells. A Data Analyst is another key role, providing the insights needed to identify growth trends and opportunities. As your team scales, consider adding a Product Marketing Manager to oversee pricing, positioning, and competitive analysis.

"A reproducible testing process is more valuable than any one idea. Innovate here first. All things equal, a team with more shots at bat wins against a team with an audacious vision."

- Nikita Bier, Product Manager

When evaluating candidates, use a project-based approach. Ask them to identify acquisition strategies, audit your product’s conversion funnel, and create sample content like ads or emails. Look for candidates who focus on building repeatable processes rather than chasing one-off "growth hacks." Over 90% of experts agree that prior growth experience is essential for a growth team lead.

Which Roles to Hire First

Your hiring priorities should align with your immediate growth challenges. Instead of trying to build an entire team from the outset, focus on roles that address your critical bottlenecks. For example:

- If activation is an issue, hire a UX/UI Designer to improve user flow and conversion rates.

- If retention is your weak spot, bring in a Customer Success Manager to reduce churn and boost expansion revenue.

- If data overwhelms your team, a Data Analyst can help extract actionable insights.

In the first year, a typical growth team might include one Growth Product Manager (PM), two or three Engineers, and one or two Data Scientists. While a dedicated growth engineer may not be necessary right away, ensure your core engineering team can allocate time for growth experiments and tool integrations. As the team matures, expect a mix of roles like Product Managers, Engineers, Data Scientists, Product Marketing specialists, Designers, and Researchers.

Early hires should be Builders - individuals who excel at setting up systems from scratch. Later, you can add Optimizers (focused on incremental improvements) and Innovators (who ideate new growth strategies, often in leadership roles). Many companies hire their first dedicated growth specialist once they have around 15 engineers working on the core product.

Seek out candidates who are deeply data-driven and curious. People who constantly ask "why" and aren’t afraid of failure are invaluable. Interestingly, 60% of growth experts interviewed by Y Combinator were former startup founders, valued for their ability to think independently and embrace experimentation. Growth teams running over 100 experiments annually often find only 20–30% yield positive results, so resilience is key.

How to Divide Responsibilities

Once your team is assembled, clearly defining responsibilities is crucial to avoid confusion and overlap. Teams can be organized by specialization (e.g., SEO, paid channels, product areas) or by key performance indicators (KPIs) like acquisition, activation, and monetization. A KPI-based structure often allows for greater flexibility and alignment with evolving business needs.

Most new growth teams focus on acquisition initially, as it provides a higher volume of users for testing. However, it’s essential to spread responsibilities across growth areas. For example:

- A Growth PM should lead experimentation and funnel optimization.

- A Customer Success Manager should focus on activation and retention.

- A Marketing Manager should oversee acquisition efforts.

Decide whether to structure your team centrally or embed growth members across departments. Centralized teams, reporting to a Head of Growth, tend to move faster and learn more quickly. Decentralized teams, where growth specialists are part of other departments, can help instill a growth mindset across the company but may progress more slowly. For early-stage companies, a centralized approach often works best to maintain focus and cohesion.

To keep your team aligned, establish regular rituals like Leads Forums for syncing on hypotheses, Work-in-Progress (WIP) Workshops for tracking experiments, and Metrics Review meetings. Build an internal dashboard to monitor experiment metrics and statistical significance - this tool becomes invaluable for onboarding new members and refining strategies. Biweekly peer reviews, where team members share hypotheses and results, can also foster rigorous analysis and collective learning.

"Most product and marketing teams are built to create or expand the core value provided to customers. Growth is connecting more people to the existing value."

- Casey Winters, Former Growth Product Lead, Pinterest

How to Transfer Knowledge from Advisors to Your Team

One of the biggest challenges when moving from advisors to an in-house team is maintaining the strategic insights behind every decision. Advisors have a deep understanding of why certain experiments succeeded or failed. Without capturing this knowledge, your team risks wasting months relearning lessons that have already been discovered.

To avoid this, start by having your advisors establish a formal offboarding process. This should involve tasks like revoking over-privileged API tokens, documenting all OAuth connections they set up, and creating a full inventory of tools and scripts they used during their time with you. Knowledge transfer requires careful planning - it’s not something you can leave to the last minute.

Pair structured documentation with real-time learning opportunities. This combination is essential, especially since 63% of customers consider onboarding support crucial.

Document Past Experiments and Results

Create a centralized repository - often called a Master Backlog Document - that captures the details of every experiment. This should include the hypothesis, methodology, results, and key lessons learned. Don’t just focus on what was done; include the reasoning behind each decision. For instance, if a pricing test didn’t perform well because customers found the structure confusing, that insight should be documented.

Introduce Experiment Enablement Checklists to outline the exact steps advisors followed to run tests. Additionally, ask your advisors to provide a Migration Toolkit containing all the scripts, API integrations, and specialized tools they used. To prepare for future improvements, conduct a Discovery Phase Report where advisors evaluate your current systems, identify outdated or redundant features, and propose a roadmap for updates.

Train Your Team Through Hands-On Work

While documentation lays a solid foundation, hands-on experience is what truly helps your team absorb and apply new knowledge. Transition your advisors from being executors to mentors in their final weeks. This allows them to guide your team through initial projects, offering feedback and support.

Set up WIP (Work In Progress) Workshops where advisors walk your team through active experiments. These sessions should explain the reasoning behind current strategies and demonstrate how results are tracked. As Andrew Capland, Founder of Delivering Value, explains:

"A head of growth needs to think of their role as a chief enablement officer. Sharing has to be part of your weekly operating system".

Incorporate observation practices like FullStory Fridays, where your team reviews recordings of real users interacting with your product. This can uncover ideas for UI updates, bug fixes, or new experiments. Additionally, organize Cross-Functional Brainstorms that bring together team members from Sales, Marketing, Customer Success, and Product. Use frameworks like ICE (Impact, Confidence, Ease) to prioritize ideas based on ROI instead of gut feelings.

Plan Handover Checkpoints to formally transition decision-making from your advisor to your internal team lead. For example, in the first week, the advisor might run all experiments while the team observes. In the second week, the team takes on a more active role under the advisor’s supervision. By the third week, the team manages experiments independently, with the advisor available for questions. This step-by-step process prevents burnout and ensures a seamless handoff.

"Execution isn't an ideas problem. It's a systems problem."

- Andrew Capland, Founder, Delivering Value

Set Up Tools and Workflows for Growth

After gathering valuable insights from your advisors, the next step is to build a solid infrastructure that supports continuous growth. This involves choosing the right platforms and setting up workflows that enable your team to test ideas, measure results, and scale successful strategies. Even the most talented teams can struggle without the right tools and processes in place.

Focus on tools that integrate seamlessly, reduce manual effort, and provide a single, reliable source of data. At the same time, establish repeatable workflows so your team can consistently run experiments without having to start from scratch each time. With advisor insights incorporated, setting up the right tools becomes a key part of driving sustained growth.

Tools You'll Need for In-House Growth

To support growth, you'll need tools for data analysis, experimentation, and automation. Start with a CRM or Customer Data Platform like HubSpot or Salesforce to centralize customer interactions. These platforms serve as the backbone of your growth efforts, helping you manage leads, track customer lifecycle stages, and automate processes between marketing, sales, and product teams.

For analytics, tools like Mixpanel, Amplitude, or Google Analytics help monitor user behavior, pinpoint conversion issues, and track key performance indicators (KPIs) like activation and retention. To test and refine strategies, use experimentation tools like Google Optimize for A/B testing and quickly measure the impact of changes.

Automation platforms such as Zapier or Make streamline repetitive tasks, like syncing CRM data with email systems or triggering onboarding workflows when a user signs up. For billing, Stripe Billing handles recurring payments, usage-based pricing, and automated invoicing. Collaboration tools like Asana, Jira, or Slack keep your team aligned and organized during growth sprints, ensuring everyone stays on the same page.

| Tool Category | Essential Platforms | Primary Support Function | Integration Requirement |

|---|---|---|---|

| CRM & CDP | HubSpot, Salesforce | Lifecycle management & lead tracking | Sync between sales, marketing, and product data |

| Analytics | Mixpanel, Amplitude, Google Analytics | User behavior & KPI monitoring | Event tracking implementation in-product |

| Testing | Google Optimize | A/B testing & experimentation | Integration with analytics for result tracking |

| Automation | Zapier, Make | Improving workflow efficiency | Connection between CRM, email, and analytics |

| Collaboration | Asana, Jira, Slack | Sprint management & team alignment | Shared dashboards for weekly growth syncs |

| Monetization | Stripe Billing | Pricing optimization & billing | Integration with product usage data |

One critical step is establishing data governance rules to ensure all teams trust the metrics and work from unified dashboards. This involves defining how data is entered, which events are tracked, and assigning ownership for each metric. Companies that implement structured growth operations have reported reducing product launch delays by 30% due to better team alignment.

Create Repeatable Growth Processes

With your tool stack in place, the next priority is creating standardized processes to ensure consistent and scalable growth. Develop workflows for core activities like A/B testing, email campaigns, and data analysis. These workflows should follow a clear cycle: hypothesis, design, execution, measurement, and documentation.

Introduce growth sprints - short cycles lasting one to two weeks - where your team focuses on testing specific ideas. Assign clear owners for each experiment and track progress daily. Use prioritization frameworks like ICE (Impact, Confidence, Ease) or RICE (Reach, Impact, Confidence, Effort) to objectively rank experiments and focus on the most promising opportunities.

As Nikita Bier, Product Manager at Facebook, puts it:

"A reproducible testing process is more valuable than any one idea. Innovate here first. All things equal, a team with more shots at bat wins against a team with an audacious vision."

Create an Experiment Enablement Checklist to standardize how tests are launched. This should include steps like defining success metrics, identifying resources, setting up tracking, and scheduling review meetings. To maintain alignment, establish regular rituals such as weekly growth syncs to review results, monthly deep dives into retention and lifetime value (LTV), and quarterly cohort analyses to evaluate long-term performance improvements.

Structure your growth efforts around the five main levers - Acquisition, Activation, Retention, Referral, and Revenue - and assign specific metrics to each. For example, track new signups and customer acquisition cost (CAC) for acquisition, first purchase rate for activation, and repeat order rate for retention. This approach helps your team pinpoint bottlenecks and allocate resources effectively.

While 90% of new growth teams tend to focus on acquisition due to the large data volume, it’s equally important to prioritize retention, especially if your 90-day retention rate falls below 80%. Balancing these efforts ensures a sustainable path to growth.

How to Transition in Phases

Switching to an in-house growth model gradually can help reduce risks and maintain stability. A phased approach allows your team to adapt, test processes, and address potential issues before they escalate.

Start with a clear timeline. For the first 1–3 months, focus on documentation and core architecture while relying on advisors for development. Over the next 3–6 months, transition responsibilities like feature development and code reviews. By months 6–12, the internal team should take the lead on development, with advisors stepping in only during peak workloads. Danny Nathan, Founder and CEO of Apollo 21, offers this advice:

"Don't over-commit. Be judicious. Hire leanly, as people are your priciest resource. Doing so will help to ensure that you know exactly what you need when you do decide that scaling up [in-house] is inevitable".

Start small, with a team of 3–6 people to keep communication efficient and agile. Poor communication is a common culprit in project failures, accounting for 56% of them. In fact, organizations lose an average of $2.1 million annually due to ineffective knowledge-sharing practices. Tackle one domain at a time - such as hypotheses, experiments, learning, and metrics - to build progress without overwhelming your team.

Start with Small Tests

Before diving into a full-scale transition, let your in-house team run small experiments. These tests help validate processes, identify weak spots, and serve as a safety net for diagnosing any engagement drops. They also confirm the viability of your growth model before committing significant resources to a full in-house setup.

For instance, conduct a pilot test using a subset of data or a small experiment before making major changes. LinkedIn’s GTM operations team, led by VP Lekha Doshi, provides a great example. When "Grade A" leads were depleted, they analyzed historical and firmographic data to identify "Grade B" accounts with high purchase potential. They then implemented a 30-60-90-day onboarding program to reduce churn for these accounts, using "variance" as a key metric to measure success. Their goal was to achieve results within 2% of their forecast.

To start, map the entire user journey - from ad click to homepage, onboarding, and purchase. Pinpoint the weakest conversion step and make it the focus of your first test. Keep in mind that it can take 6 to 12 months for growth leaders to fully understand a company’s specific challenges and deliver results. Also, remember that only 20% to 30% of experiments typically succeed in high-performing teams, so failures are part of the process.

Roll Out Changes Slowly

Once your pilot tests show positive results, introduce new workflows gradually and gather feedback before scaling fully. Instead of waiting for a "perfect" in-house setup, launch a Minimum Viable Service (MVS). Oded Rosenmann, Global Lead of SaaS Partner Strategy & Growth at AWS, explains:

"Rather than focusing time on making a product 'perfect,' launching a minimum viable service as quickly as possible can validate whether the approach delivers meaningful value to customers".

As you onboard new hires, integrate them into workflows before phasing out external support. This ensures they understand the technical context and product roadmap. If transitioning data systems during live operations, use incremental loading strategies to maintain consistency while syncing old and new systems.

Interestingly, 57% of SaaS companies report faster campaign launches when using a hybrid model of outsourced and in-house marketing. Stick with this hybrid approach during the transition and review your in-house versus outsource balance quarterly to stay aligned with changing priorities, budgets, or market trends. Be prepared for setbacks as you implement changes.

Plan for Rollbacks

Even with careful planning, unexpected issues can arise. Prepare backup plans to revert to previous systems if critical problems occur. Before starting any migration or transition, create a comprehensive backup of all legacy data to avoid data loss.

Have a formal rollback protocol in place - a documented plan to revert to the original system if critical errors occur. As MigrateMyCRM advises:

"A rollback plan should be established to revert to the original system if critical errors occur. These precautions ensure data integrity and provide peace of mind throughout migration".

Develop a disaster recovery framework that outlines recovery strategies for different failure scenarios, identifies resources for managing recovery, and includes a schedule for testing the plan’s effectiveness. Regularly test rollback and recovery protocols to confirm they work as intended. Marciela Ross from Walnut highlights the importance of this:

"Having an exit strategy minimizes disruption and ensures business continuity if your current SaaS provider no longer meets your needs".

| Strategy Component | Purpose | Key Action |

|---|---|---|

| Data Backup | Prevent data loss | Complete legacy data backup before each phase |

| Disaster Recovery | Ensure continuity | Define and test recovery steps |

| Exit Strategy | Maintain flexibility | Plan for data migration back |

How to Measure Results and Keep Improving

After transitioning operations in-house, it's essential to track the right metrics to distinguish your team's contributions from broader market trends. Start by setting clear KPIs that reflect both efficiency and growth, then use these benchmarks to guide your strategy.

Monitor Key Metrics After the Transition

Once you've outlined your KPIs, create a baseline forecast to represent performance without in-house efforts. This helps you pinpoint whether improvements are due to your team's initiatives or just external momentum. Regularly compare actual results against this baseline to assess progress.

Some key efficiency and growth metrics to focus on include:

- Customer Acquisition Cost (CAC) Payback Period: Aim for less than 18 months.

- Magic Number: For companies with $5M–$20M ARR, a Magic Number above 0.75 is a good target.

- Net Revenue Retention (NRR): Elite companies maintain over 120%, while the median is 106%.

"Strong cohort retention curves that flatten out (rather than drop to zero) are one of the strongest indicators of product-market fit".

Using cohort analysis, you can group users by when they joined to see if your in-house efforts are improving retention and lifetime value compared to the advisor-led period. For companies in the $5M–$20M ARR range, the Rule of 40 is another useful benchmark - your combined growth rate and profit margin should hit or exceed 40%.

| Metric Category | Key KPI | Success Benchmark |

|---|---|---|

| Efficiency | CAC Payback Period | < 18 months |

| Efficiency | Magic Number | > 0.75 |

| Retention | Net Revenue Retention (NRR) | 100%–120%+ |

| Growth | ARR Growth Rate ($5M–$20M) | 100%–150% YoY |

| Profitability | Rule of 40 | Growth + Margin ≥ 40% |

Focus on one primary KPI that best reflects your service's success and review it weekly. This keeps your team aligned on improving performance.

"What is measured, improves".

It’s also important to balance leading indicators (like engaged leads or website traffic) with lagging indicators (such as churn rate or profit margin). For product engagement, track the DAU/MAU ratio - a declining ratio could signal that users are losing interest.

Use Data to Improve Your Work

Tracking metrics is only the first step. The real value lies in using that data to refine your strategies. Set up a feedback loop so that every result informs your next decision.

"Operating your SaaS company without metrics is like flying a plane without instruments. Yeah, you are up in the air, but you might not know where you are headed".

When performance falls short, look for growth constraints - factors that slow down progress, such as diminishing returns on acquisition efforts. For example, if retention is weak, analyze Depth of Usage to see if users are engaging with multiple features or dropping off after their initial "aha moment".

Before scaling acquisition efforts, address churn by improving onboarding or using in-app messaging to highlight underused features. Retaining customers is far more cost-effective than acquiring new ones - keeping an existing customer costs about 1/7th as much, and a 5% boost in retention can increase profits by 25% to 95%.

Experimentation is key. Run small-scale tests to validate new growth ideas before scaling them. Measure the performance of different channels and adjust based on results. When forecasting, consider the confidence level of each initiative and discount expected outcomes to set realistic executive expectations.

Hold weekly metrics review meetings and create a shared dashboard to ensure cross-team alignment. Avoid overwhelming your team with too much data - start with high-level metrics like company-wide revenue, and only dive into granular details when necessary. Transition from manual spreadsheets to automated dashboards for real-time insights into performance gaps. These practices will help you fine-tune your in-house growth strategy over the long term.

Conclusion

Shifting your growth efforts in-house takes thoughtful planning and a good dose of patience. Expecting overnight success isn’t realistic. Companies that thrive in this transition are those that assess their readiness and build their teams with intention.

Start by ensuring you’ve achieved stable retention and product-market fit before making any hires. When you do hire, focus on bringing in builders - people who can execute - rather than strategists who only focus on planning. Your first hire should tackle the biggest pain point, which is often related to acquisition. Instead of overhauling everything at once, transition gradually. Keep your existing systems running while testing new processes until they’re proven to work.

"Sustainable growth is about evolution, not revolution." - Elena Verna and Andrea Wang

The real challenge begins once the transition is underway. Foster a culture of experimentation, understanding that only 20%-30% of tests are likely to succeed. Document every attempt, successful or not, so future team members can build on your learnings. Use prioritization frameworks like ICE or RICE to focus on initiatives that deliver the most impact. Regular rituals, such as Leads Forums and Ideation Workshops, are key to maintaining alignment across teams.

Keep in mind that 43% of software vendors take one to three years to fully transition successfully. This process demands a long-term commitment to building a team that not only understands your product deeply but can also adapt quickly to market changes without leaning on external consultants.

FAQs

How do I know if my company is ready to bring SaaS growth efforts in-house?

Deciding whether to shift your SaaS growth efforts in-house means taking a close look at a few important areas. First, evaluate where your company stands in its growth journey. Are you at a stage where consistent strategies and execution are essential to keep momentum? If so, this might be the right time to consider making the move.

Next, assess your internal resources. Do you have the budget, the right tools, and - most importantly - a team with the expertise to handle growth initiatives? It’s not just about having people; it’s about having the right people who can take on these responsibilities effectively.

Finally, think about your team’s capacity. Do they have the bandwidth and skills to manage growth without leaning on outside help? If there are gaps in knowledge or resources, you might need to invest in training or hire specialists to fill those voids. Preparing your team properly can make all the difference in ensuring a smooth transition and setting the stage for long-term success.

What roles are essential for building a successful in-house SaaS growth team?

To create a strong in-house growth team for a SaaS company, you need to bring together roles that target customer acquisition, retention, and revenue expansion. Some key positions to consider are growth marketers, who craft and implement strategies, along with specialists in product marketing, data analysis, and user experience. Together, these roles provide a balanced approach to driving business growth.

Your team should also include individuals who deeply understand SaaS-specific hurdles, like converting free users into paying customers or boosting retention rates. Depending on where your company is in its journey, roles such as growth product managers, data analysts, and marketing specialists can play a crucial part in building momentum. A team with the right expertise, aligned with your strategic goals, can position your business for long-term success.

What’s the best way to measure the success of transitioning SaaS growth in-house?

To gauge how well your in-house efforts are driving SaaS growth, it’s essential to monitor key performance indicators (KPIs) that provide a clear picture of your business’s health and trajectory. Some of the most important metrics to track include:

- Monthly Recurring Revenue (MRR): A direct measure of predictable, recurring income.

- Churn Rate: The percentage of customers who stop using your service within a given period.

- Customer Acquisition Cost (CAC): How much it costs to acquire a new customer.

- Customer Lifetime Value (CLV): The total revenue you can expect from a customer over their relationship with your business.

Beyond these metrics, tools like cohort analysis can be incredibly helpful. They allow you to study customer retention trends and uncover patterns in user behavior over time. It's also crucial to assess how effectively your in-house team is performing compared to external advisory services, making adjustments to your strategies when necessary to maximize growth.

Built by Artisan Strategies

Here at Artisan Strategies we both help companies accelerate their own revenue and launch our own products to improve your daily life. Whether it's for productivity (Onsara for macOS) or simply a better dictionary in Chrome (Classic Dictionary 1913), we've built something for you.