How Growth Advisors Help SaaS Startups Scale

Part-time growth advisors help SaaS startups build repeatable systems for onboarding, pricing, and retention to scale ARR and improve key metrics.

How Growth Advisors Help SaaS Startups Scale

Scaling a SaaS startup from $1M to $10M ARR is tough. Early strategies like founder-driven hustle and personal networks often fall short at this stage. Growth advisors step in as part-time experts to help startups build structured systems for user activation, pricing, and retention. They bring an external perspective, unbiased advice, and proven methods to solve scaling challenges without the cost of full-time executives.

Key Takeaways:

- Role of Growth Advisors: Help shift startups from hustle-driven to process-driven growth.

- Focus Areas: Improve onboarding, refine pricing, and reduce churn.

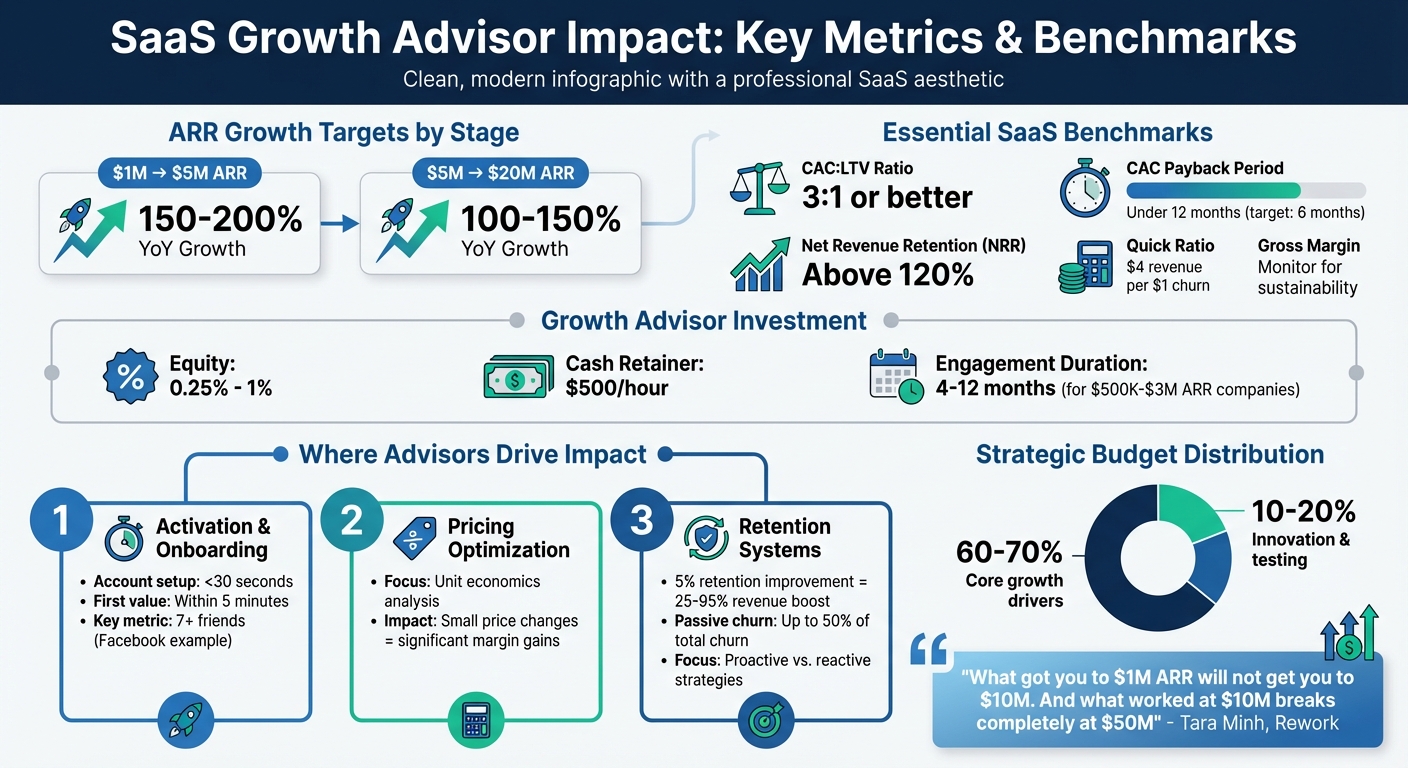

- Cost-Effective Support: Typically compensated with equity (0.25%-1%) or cash retainers ($500/hour).

- Impact Metrics: Aim for a CAC:LTV ratio of 3:1, NRR above 120%, and fast payback periods (under 12 months).

By targeting specific bottlenecks and tracking metrics like ARR, churn, and NRR, growth advisors provide actionable roadmaps for sustainable growth.

Key SaaS Growth Metrics and Benchmarks for Scaling Startups

How to Build a Scalable SaaS Growth Engine (From Startup to Acquisition)

sbb-itb-0499eb9

Where Growth Advisors Make the Biggest Difference

Growth advisors don’t aim to overhaul everything at once. Instead, they zero in on three key areas where even small tweaks can lead to noticeable revenue growth: speeding up user activation, optimizing pricing, and reducing customer churn. Let’s break down how they refine onboarding, pricing, and retention strategies to make a measurable impact.

Improving Activation and Onboarding

The faster users see value, the more likely they are to stick around. Growth advisors focus on streamlining onboarding to remove obstacles and help users reach their first "aha moment" quickly. Take Facebook’s example: their growth team found that users who added 7+ friends within the first few days were much more likely to stay engaged. This insight shaped their entire onboarding process.

Advisors often divide onboarding into three stages:

- Account setup: This step should be lightning-fast - think under 30 seconds. Auto-fill data wherever possible and cut out any unnecessary fields.

- First value moment: Users should experience the product’s core benefit within five minutes. Pre-loaded demo data often helps here by showing results without requiring manual input.

- Feature discovery: Instead of overwhelming users upfront, advisors introduce features gradually through tooltips and progressive unlocking.

To keep users engaged beyond the initial setup, advisors implement email sequences that guide them through setup, highlight key features, and nudge them toward conversion.

Increasing Revenue Through Pricing Tests

Many SaaS companies leave money on the table by sticking with untested pricing models. Growth advisors address this by running experiments to pinpoint what customers are willing to pay. As Breakthrough3x puts it, "Tiny price movements can enhance margins significantly as unit volumes increase".

Advisors begin by analyzing unit economics, which involves calculating per-unit profitability after factoring in costs like customer acquisition and overhead. This analysis reveals which customer segments are the most lucrative and where pricing adjustments can make the biggest difference. Advisors also experiment with strategies like bundling, modifying trial lengths, and testing different delivery models. For example, simpler products often thrive on 7-day trials to create urgency, while more complex software may need 30-day trials to give users enough time to explore.

Reducing Churn with Retention Systems

Rather than reacting to churn as it happens, growth advisors help startups build proactive systems to identify and address risks early. As Chris Pilbeam explains, "If your customer success strategy is still centered around catching churn in real time, you're behind".

Advisors develop lifecycle communication systems using tools like email, in-app messaging, and push notifications to maintain user engagement. They also implement Customer Health Scores, which consolidate engagement metrics into a single dashboard. This allows teams to step in when users show signs of disengagement. The payoff is huge: improving retention by just 5% can boost revenue by 25% to 95%.

Another focus is addressing passive churn, like failed payments, which can account for up to 50% of churn cases. Advisors also prioritize Net Revenue Retention (NRR) over Gross Retention because NRR includes expansion revenue, meaning it can exceed 100%. This approach not only keeps customers longer but also increases their value over time through upsells and feature adoption.

Building Long-Term Growth Strategies

When it comes to scaling a SaaS startup, growth advisors emphasize the importance of creating a long-term blueprint, not just focusing on the immediate quarter. By diagnosing bottlenecks across six critical areas - Market, Product, Messaging, Economics, Process, and Distribution - they help startups address the root causes of challenges instead of just managing symptoms. This thorough diagnosis shapes every decision that follows.

The strategies vary depending on a startup's stage. For those still chasing product-market fit, the focus is on discovery and testing hypotheses. Meanwhile, startups that have reached product-market fit shift their attention to scaling both acquisition and retention. As Tara Minh from Rework aptly explains:

"What got you to $1M ARR will not get you to $10M. And what worked at $10M breaks completely at $50M".

To ensure progress, advisors often break down these long-term plans into 90-day roadmaps. These roadmaps come with clear milestones and assigned owners, making them actionable and measurable.

Bridging Cross-Functional Gaps

One common hurdle for startups is aligning different teams - CEOs, CMOs, and CFOs - on a unified strategy. Growth advisors play a vital role here, translating goals into actionable product roadmaps and measurable financial outcomes. Consider Nexl, a legal tech company: in 2025, advisor Allen Zhu analyzed their customer data and found that law firms with 50+ employees brought the most value. This insight helped unify their sales and marketing teams around an account-based strategy. Similarly, Ignition, an accounting software company, grew by following their customers' workflows from proposals to invoicing and re-engagement. This approach not only boosted retention but also created high switching costs. These examples highlight how precise insights can lead to cohesive, growth-oriented strategies.

Resource Allocation and Strategic Balance

Advisors also guide startups in prioritizing resources. Generally, 60-70% of funding is directed toward core growth drivers, while 10-20% is set aside for innovation and testing new markets. This balance ensures that immediate optimizations are supported without neglecting future opportunities. Regular monthly reviews and quarterly strategy sessions help teams stay aligned and on track.

For financial benchmarks, effective strategies aim for a CAC:LTV ratio of 3:1 or better and a payback period of under 18 months. Startups scaling from $1M to $5M ARR often target 150-200% year-over-year growth, while those moving from $5M to $20M ARR aim for 100-150% growth. These metrics set the stage for rigorous tracking and fine-tuning, which are crucial for sustained success in the SaaS world.

Tracking Results with SaaS Metrics

To complement long-term growth strategies, tracking the right metrics is essential for ensuring every decision delivers measurable results. Growth advisors rely on data-driven insights to connect product decisions to financial outcomes, offering a clear picture of progress. Without proper tracking, it’s hard to tell if your strategies are making a real impact. Let’s dive into the key metrics advisors monitor to keep SaaS businesses on track.

Main SaaS Metrics Growth Advisors Track

Certain metrics stand out as critical for understanding and driving growth. Net Revenue Retention (NRR) is one of the most important - it shows whether revenue from existing customers is increasing through upselling and expansion. High-performing SaaS companies aim for an NRR above 120%, a sign of "negative churn", where gains from existing customers offset any losses [25,27].

Customer Acquisition Cost (CAC) is another must-watch metric, especially its payback period. Growth advisors target an LTV:CAC ratio greater than 3:1, meaning every dollar spent on acquiring customers should generate at least three dollars in lifetime value. Ideally, startups should recover CAC within 12 months, with a goal of eventually reducing it to six months [27,33].

Revenue growth is measured through Monthly Recurring Revenue (MRR) and Annual Recurring Revenue (ARR). These metrics indicate market traction and whether the business is gaining or losing momentum [25,26]. Advisors also look closely at Customer Churn (the number of customers lost) and Revenue Churn (the financial impact of churn). If revenue churn is higher than customer churn, it’s a sign that high-value customers are leaving [27,31].

Other key metrics include Gross Margin and Burn Multiple, both of which help assess financial sustainability. These figures show how much time a company has before needing additional funding [25,27]. Morgan Brown, former Head of Growth at Qualaroo, emphasizes the importance of retention:

"Retention rate is your best measure of a product/market fit. The higher your retention rate the more it's a must-have product".

Using Dashboards and Running Experiments

Once metrics are defined, dashboards and experiments help turn data into actionable insights. Growth advisors establish weekly tracking routines for key performance indicators (KPIs) to ensure they stay on top of progress. Weekly updates make it clear whether growth efforts are working as planned. As Ben Holmquist, Co-founder and CEO of Penji, puts it:

"What is measured, improves".

Experimentation is where the real work happens. Advisors run A/B tests on specific parts of the customer journey - like simplifying sign-up forms - to pinpoint changes that deliver the best results [28,29]. Each experiment follows a structured cycle: brainstorm, test, execute, and evaluate.

To dig deeper, advisors often analyze metrics by service or customer persona rather than relying solely on company-wide averages. For example, calculating Quick Ratios for individual offerings can uncover weak areas that overall averages might mask. A Quick Ratio above 4 indicates efficient growth, meaning $4 in revenue is generated for every $1 lost to churn.

To avoid being overwhelmed by data, advisors tailor dashboards to specific goals or departments. They ensure all metrics meet SMART criteria - Specific, Measurable, Attainable, Realistic, and Time-bound. This approach keeps teams focused on what truly matters, avoiding distractions from less relevant data points.

Conclusion

Growth advisors play a pivotal role in helping SaaS startups transition from random experiments to a scalable, repeatable growth engine. They tackle bottlenecks across key areas like market fit, product development, messaging, unit economics, operational processes, and distribution channels. By doing so, they provide startups with the clarity and structure needed to execute proactive growth strategies through short-term, actionable roadmaps.

The impact of this guidance is evident in real-world success stories. Take MarketEdge, for example: the SaaS company increased its monthly recurring revenue by 62.5% - from $40,000 to $65,000 - in just 90 days by working with Agile Growth Labs to build a predictable lead-generation system. Similarly, Social Link optimized its operations, achieving a six-figure exit within eight months by focusing on profitability and acquisition readiness. Another example is Violet Advisory, which helped businesses in over 50 countries generate $550 million in incremental revenue and $1.3 billion in enterprise value over seven years.

These examples highlight how targeted advisory support leads to measurable business outcomes. Advisors don’t just assist with scaling - they build the foundation for it. They implement real-time data systems, introduce fractional leadership to prevent bottlenecks, and guide founders in evolving from hands-on operators to strategic decision-makers. As Breakthrough3x aptly puts it:

"Scaling means shifting the way that leaders think about time, risk, and control. It's about shifting from doing to enabling".

The key to success lies in finding the right advisor for your specific stage of growth and setting clear goals from the outset. Most advisory engagements for B2B SaaS companies - particularly those with annual recurring revenues between $500,000 and $3 million - span four to 12 months. Whether the focus is on reducing CAC payback periods, improving retention, or preparing for an acquisition, the right advisor brings the expertise and direction needed to deliver meaningful results.

FAQs

How do growth advisors create effective pricing strategies for SaaS startups?

Growth advisors play a key role in helping SaaS startups develop pricing strategies that work. They rely on a mix of data-driven experimentation, customer insights, and behavioral economics to find the sweet spot for pricing. One of their main tactics? Running pricing tests. These tests help uncover the price points and models that strike the right balance between boosting revenue and keeping customers happy. It’s all about fine-tuning through an ongoing, iterative process.

Another important tool in their arsenal is value-based pricing. This approach focuses on understanding how customers view the product’s worth. By identifying what different customer groups are willing to pay, advisors can adjust pricing to better align with customer expectations and drive growth.

But it doesn’t stop there. Growth advisors also look at the bigger picture - market trends, competition, and the company’s stage of growth - all of which influence pricing decisions. This well-rounded strategy ensures SaaS startups can grow steadily while addressing what their customers need.

What essential metrics do growth advisors monitor to help SaaS startups scale successfully?

Growth advisors zero in on a handful of key metrics to help SaaS startups grow effectively while maintaining balance. These metrics include:

- Activation rate: This tracks how quickly new users reach the point where they experience your product's core value after signing up.

- Time-to-value: This measures the time it takes for users to achieve meaningful results or benefits from using your product.

- Cohort lifetime value (LTV): This monitors the revenue generated by specific user groups over the course of their relationship with your product.

- Expansion readiness: This assesses if your product and internal processes are equipped to scale without compromising quality or user experience.

By diving into these metrics, growth advisors pinpoint areas for improvement, fine-tune strategies, and guide businesses toward sustainable growth tailored to their unique goals.

How do growth advisors help SaaS startups reduce customer churn?

Growth advisors are essential for SaaS startups aiming to reduce customer churn. Their primary focus is on retention strategies and creating a better customer experience. By analyzing data, they can pinpoint customers at risk of leaving and take proactive steps like personalized outreach, customized engagement plans, and strengthening customer support.

Another key area they tackle is onboarding. Growth advisors refine this process to help new users quickly grasp the product's value, cutting down on early churn. Through improved customer success initiatives and building lasting relationships, they enable SaaS companies to retain more customers, boost lifetime value, and achieve steady growth.

Built by Artisan Strategies

Here at Artisan Strategies we both help companies accelerate their own revenue and launch our own products to improve your daily life. Whether it's for productivity (Onsara for macOS) or simply a better dictionary in Chrome (Classic Dictionary 1913), we've built something for you.