how much more do marketers spend on new customer acquisition vs. expanding revenue from existing customers in saas

Marketers spend ~20% more on new SaaS customers even though acquisition costs 5–25× more than expansion; focus on LTV:CAC and NRR.

how much more do marketers spend on new customer acquisition vs. expanding revenue from existing customers in saas

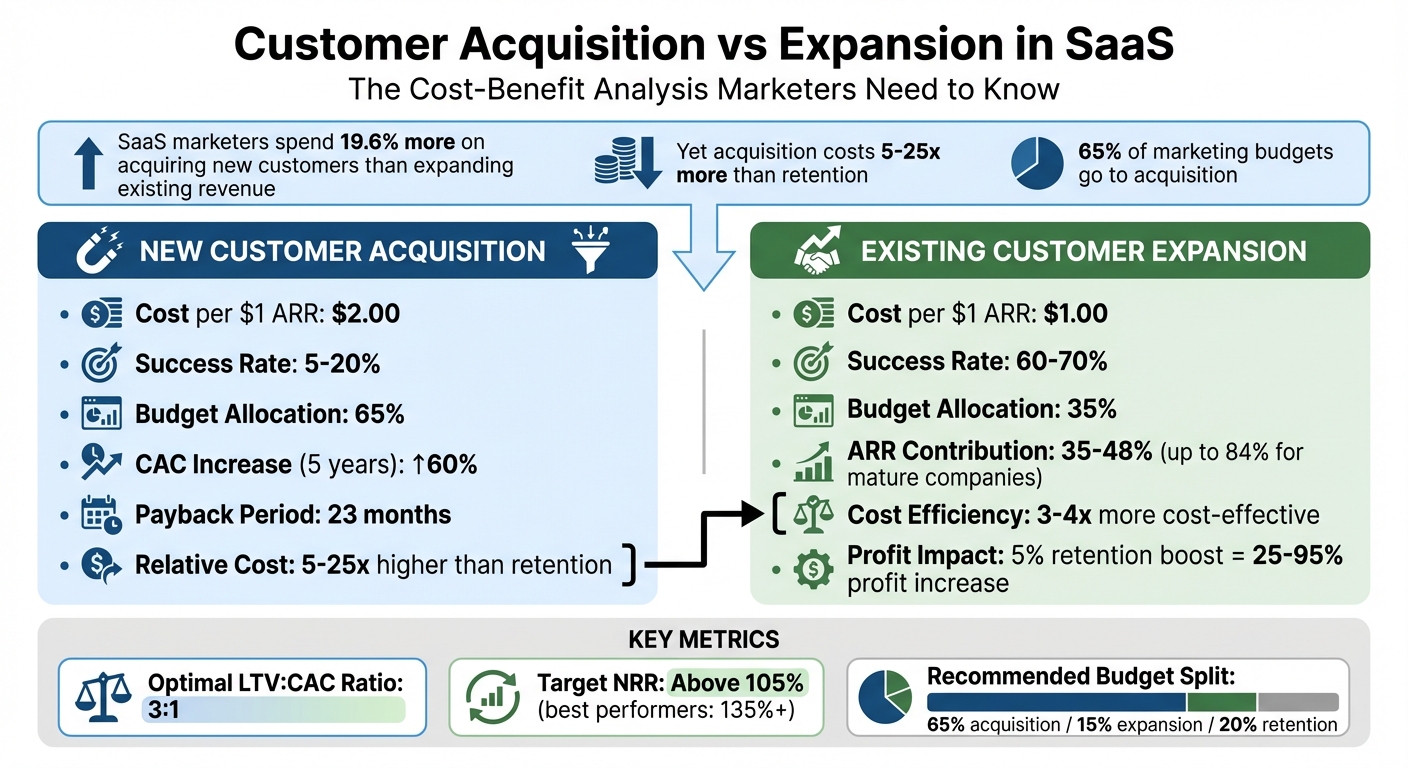

SaaS marketers spend 19.6% more on acquiring new customers than on expanding revenue from existing ones. Yet, acquiring a new customer costs 5 to 25 times more than retaining one. Despite this, businesses allocate 65% of their marketing budgets to acquisition. Here's why this matters:

- Acquisition Costs: $2.00 spent for every $1.00 of new Annual Recurring Revenue (ARR).

- Expansion Costs: Only $1.00 per $1.00 of ARR from existing customers.

- Success Rates: Selling to existing customers has a 60-70% chance, compared to 5-20% for new prospects.

- Profit Impact: A 5% boost in retention can increase profits by 25-95%.

While acquisition dominates budgets, rising Customer Acquisition Costs (up 60% in 5 years) and longer payback periods (averaging 23 months) highlight the need for a better balance. Mature SaaS companies already rely on 84% of ARR growth from existing customers, showing the efficiency of focusing on retention and upselling.

To optimize growth, companies should measure metrics like LTV:CAC ratio (aim for 3:1) and Net Revenue Retention (above 105%). Balancing acquisition and expansion is critical for profitability and long-term success.

SaaS Customer Acquisition vs Expansion Costs: A Data-Driven Comparison

1. New Customer Acquisition Budgets

Cost Differences

In 2024, the typical SaaS company spent $2.00 in sales and marketing expenses to generate $1.00 of new Annual Recurring Revenue (ARR) from new customers. For companies in the bottom quartile, this figure climbs to $2.82 per $1.00 of new ARR. In comparison, expanding revenue from existing customers costs just $1.00 per $1.00 of ARR. Simply put, acquiring new customers is twice as expensive as growing revenue from current ones.

The cost gap becomes even more striking when viewed on a larger scale. Bringing in a new customer is 5 to 25 times more expensive than retaining an existing one, and 3 to 4 times costlier than upselling to a current account. This explains why acquisition efforts dominate marketing budgets, typically accounting for 65% of total sales and marketing spend according to industry norms. These stark cost differences highlight the challenges of balancing acquisition with profitability.

ROI and Profitability

The growing inefficiency of customer acquisition is hard to ignore. Over the past five years, Customer Acquisition Costs (CAC) have risen by 60%, with payback periods now averaging 23 months. This means it takes nearly two years to recover the money spent acquiring a single customer.

Adding to the challenge, selling to a new prospect comes with a 5-20% success rate, while the odds improve dramatically to 60-70% when selling to an existing customer. Despite these numbers, companies continue to prioritize acquisition over retention. Why? While a 5% increase in customer retention can drive profits up by 25% to 95%, the allure of landing new customers often overshadows the long-term profitability of nurturing current ones. This misalignment puts pressure on unit economics, which we'll explore further.

Business Impact

For SaaS companies with an Annual Contract Value (ACV) above $10,000, maintaining a New CAC Ratio of $1.50 or lower is critical for efficiency. Exceeding this ratio can strain unit economics and risk triggering what experts call the "Startup Killer" effect - when CAC far outweighs customer lifetime value (LTV). A healthy LTV:CAC ratio of 3:1 is considered the baseline for a sustainable business, while anything below 2:1 signals immediate operational concerns.

The shift toward more efficient spending is already underway. In 2023, the share of marketing budgets allocated to new business acquisition dropped from 51% to 47%, reflecting a growing awareness of the unsustainable nature of rising acquisition costs. However, acquisition spending still dominates, even though existing customers consistently drive more profitable growth.

2. Existing Customer Expansion Budgets

Cost Differences

When it comes to cost efficiency, expanding revenue from existing customers is a clear winner. For every $1 of Annual Recurring Revenue (ARR) gained through expansion, the cost is just $1.00. In contrast, acquiring new customers costs between $1.76 and $2.00 for the same ARR. Even though the Expansion CAC Ratio rose by 45% year-over-year - from $0.69 in 2022 to $1.00 in 2023 - expansion is still three to four times more cost-effective than bringing in new customers. This shift reflects a deliberate reallocation of resources like personnel, marketing budgets, and tools toward maximizing the value of existing customers. These cost advantages make expansion a highly attractive strategy for boosting ROI.

ROI and Profitability

The numbers don’t lie: existing customers are far more likely to make repeat purchases, with a 60% to 70% chance of buying again, compared to just 5% to 20% for new prospects. This higher probability means every dollar spent on existing customers delivers better returns.

"A 5% improvement in retention drives 25-95% profit increases, yet 75% of software companies saw declining retention in 2024." – Matteo Tittarelli, Genesys Growth

Currently, expansion ARR contributes between 35% and 48% of total new ARR in the SaaS industry, with top-performing companies seeing this figure climb as high as 67%. For large enterprises generating over $500 million in annual revenue, existing customers are responsible for an impressive 84% of ARR growth. Clearly, the profitability of expansion far outweighs its costs.

Business Impact

The advantages of focusing on existing customers extend beyond cost and ROI. Net Revenue Retention (NRR) has become a critical metric for SaaS companies, directly influencing valuations. Companies with an NRR above 120% enjoy valuation multiples that are 50% to 100% higher than those with lower NRR. While a healthy SaaS business typically aims for an NRR above 105%, the best performers push this number past 135%.

Reflecting this shift in priorities, marketing teams now allocate 53% of their budgets to initiatives targeting existing customers, a notable shift from the past when acquiring new customers dominated spending. However, fewer than 20% of companies actively track their Expansion CAC Ratio, leaving many without a clear understanding of how efficiently they’re growing. Measuring this ratio is essential for validating expansion strategies and ensuring resources are allocated effectively between acquisition and retention efforts.

Do You Have Balance Between CAC Payback and Retention? | SaaS Metrics School | CAC and GRR

sbb-itb-0499eb9

Pros and Cons

When deciding between customer acquisition and expansion strategies, SaaS companies face distinct trade-offs that influence their budget priorities. Each approach offers its own advantages and challenges, shaping how businesses grow and sustain profitability.

New customer acquisition is crucial for increasing market share, introducing new products, and meeting investor demands for rapid growth. It provides an immediate boost to annual recurring revenue (ARR) and expands the total addressable market. However, the costs are steep - acquiring new customers is far more expensive than retaining existing ones, with customer acquisition costs (CAC) rising by 222% over the past eight years. Additionally, an overemphasis on acquisition without adequate post-sale support can lead to higher churn rates, often referred to as the "leaky bucket" problem.

Existing customer expansion offers a more cost-effective route, typically yielding higher returns on investment and better conversion rates. As mentioned earlier, existing customers are far more likely to convert compared to new prospects. Even a small 5% boost in retention can drive profits up by 25% to 95%. However, focusing solely on expansion may limit your ability to capture new market segments or grow your overall customer base, which can be a disadvantage in fast-evolving markets.

"You can't really choose one over the other. You need both. You have to bring customers in, and once you get them, you must engage in activities that will keep them engaged and help them realize value."

– Alan Stoffer, Partner, Worqflow

To achieve sustainable growth, the most successful SaaS companies balance both strategies. A commonly recommended framework is the 65/15/20 rule: allocate 65% of your sales and marketing budget to acquisition, 15% to expansion, and 20% to retention. This approach ensures a steady influx of new customers while maximizing the value of existing ones.

Here’s a quick comparison of the two strategies:

| Feature | New Customer Acquisition | Existing Customer Expansion |

|---|---|---|

| Primary Goal | Market share and user growth | Profitability and LTV maximization |

| Relative Cost | 5× to 25× higher | Significantly lower |

| Success Probability | 5% to 20% | 60% to 70% |

| Revenue Impact | Immediate ARR boost | Long-term predictable growth |

| Main Risk | High churn and resource strain | Slower market penetration |

| Key Metrics | CAC, lead generation, conversion rate | NRR, upsell rate, ARPA |

Striking the right balance between these strategies ensures that your business grows while maintaining a strong foundation of loyal customers.

Conclusion

SaaS marketers are investing nearly three times more in acquiring new customers than in expanding revenue from existing ones. On average, securing $1 in annual contract value (ACV) from new customers costs about $1.78, while expansion efforts only require around $0.61 per dollar of ACV gained. Interestingly, expansion annual recurring revenue (ARR) now makes up 48% of the total combined ARR from new and expansion sources - an increase from 35% just two years ago.

For early-stage companies with ARR under $10 million, it’s recommended to allocate 20–40% of revenue toward marketing, with a focus on acquisition. On the other hand, for companies exceeding $500 million in ARR, 84% of growth typically comes from existing customers, making expansion the key driver of revenue.

To optimize growth strategies, measure critical performance metrics such as the LTV:CAC ratio (aim for at least 3:1), CAC payback period (under 12 months), and Net Revenue Retention (above 105%). Separating CAC calculations for new customer acquisition and expansion can provide clarity on where marketing dollars deliver the highest returns. These metrics are essential for striking the right balance between acquisition and expansion.

"Marketing should become a lynchpin of expansion, collaborating cross-functionally with sales, customer success, and product teams to foster a cohesive strategy."

– Charlene Chen, Dustin Zaloom, and Pax Kaplan-Sherman, Insight Partners

Additionally, evaluating your funnel for leakage can help pinpoint where potential customers are dropping off. If your conversion rates remain strong but growth slows, it might be time to shift focus toward expansion. Supporting this shift, 83.6% of Customer Success leaders predict an increase in expansion revenue by 2025. This growing emphasis on monetizing existing customers highlights a shift toward more sustainable and efficient growth strategies in the SaaS industry.

FAQs

Why do SaaS companies prioritize spending on acquiring new customers over retaining existing ones?

SaaS companies often dedicate a larger portion of their marketing budgets to bringing in new customers. Why? Because boosting top-line annual recurring revenue (ARR) is essential for demonstrating product-market fit, capturing market share, and meeting the expectations of investors. Plus, acquiring new customers allows businesses to explore fresh markets or industries, making it a top priority for leadership teams.

That said, getting new customers is far from cheap. The customer acquisition cost (CAC) - which includes things like advertising, sales team salaries, commissions, technology, and content creation - can be 5 to 7 times higher than the cost of retaining existing customers. Even with these steep expenses, companies see acquisition as a must. A larger customer base not only drives immediate growth but also opens doors for upselling, cross-selling, and referrals down the line.

Why should SaaS companies focus on growing revenue from existing customers?

Expanding revenue from your current customers often costs less than bringing in new ones. Why? The Customer Acquisition Cost (CAC) is usually much steeper than the cost of retaining and upselling to existing customers. This means that investing in your current customer base tends to yield a better return and boosts overall profitability. Plus, focusing on your existing customers can improve Net Revenue Retention (NRR) - a critical metric for SaaS businesses. Companies with NRR above 120% often enjoy higher valuations, thanks to the steady, compounding growth that strong retention delivers.

But it’s not just about saving money. Prioritizing your current customers leads to a more stable revenue stream. Businesses that focus on retention and upselling often see higher Lifetime Value (LTV), lower churn rates, and stronger customer loyalty. This strategy supports long-term growth while reducing the need for costly, aggressive acquisition campaigns.

How can SaaS companies effectively balance spending on acquiring new customers versus growing revenue from existing ones?

To find the right balance between bringing in new customers and increasing revenue from your current ones, SaaS companies should focus on key metrics and adjust budgets accordingly. Start by calculating your Customer Acquisition Cost (CAC) and comparing it to your Customer Lifetime Value (LTV). If your CAC is more than about 30% of your LTV, it could mean you're overspending on acquiring new customers instead of nurturing the ones you already have. Another critical metric to watch is Net Revenue Retention (NRR). An NRR above 100% is a good sign - it means you can confidently invest more in acquiring new customers. On the other hand, a lower NRR suggests it’s time to focus on retention and upselling strategies.

Using a test-and-learn approach can also help you fine-tune your spending. Try small experiments across acquisition channels like paid ads or content marketing. At the same time, test expansion strategies such as upsell campaigns or personalized offers. Use the results to shift your budget toward the tactics that deliver the best results for growth. Finally, make sure your sales, customer success, and product development teams are aligned with shared goals for both acquisition and retention. This alignment ensures a balanced approach that grows your customer base while boosting the profitability of your existing one.

Go deeper than any blog post.

The full system behind these articles—frameworks, diagnostics, and playbooks delivered to your inbox.

No spam. Unsubscribe anytime.