which is actually better zuora vs stripe vs orb for usage-based billing in saas with complex metering and hybrid subscription + consumption models

Compare Zuora, Stripe, and Orb for hybrid subscription + usage billing in SaaS—pricing, setup time, scalability, and which fits startups, high-volume apps, or enterprises.

which is actually better zuora vs stripe vs orb for usage-based billing in saas with complex metering and hybrid subscription + consumption models

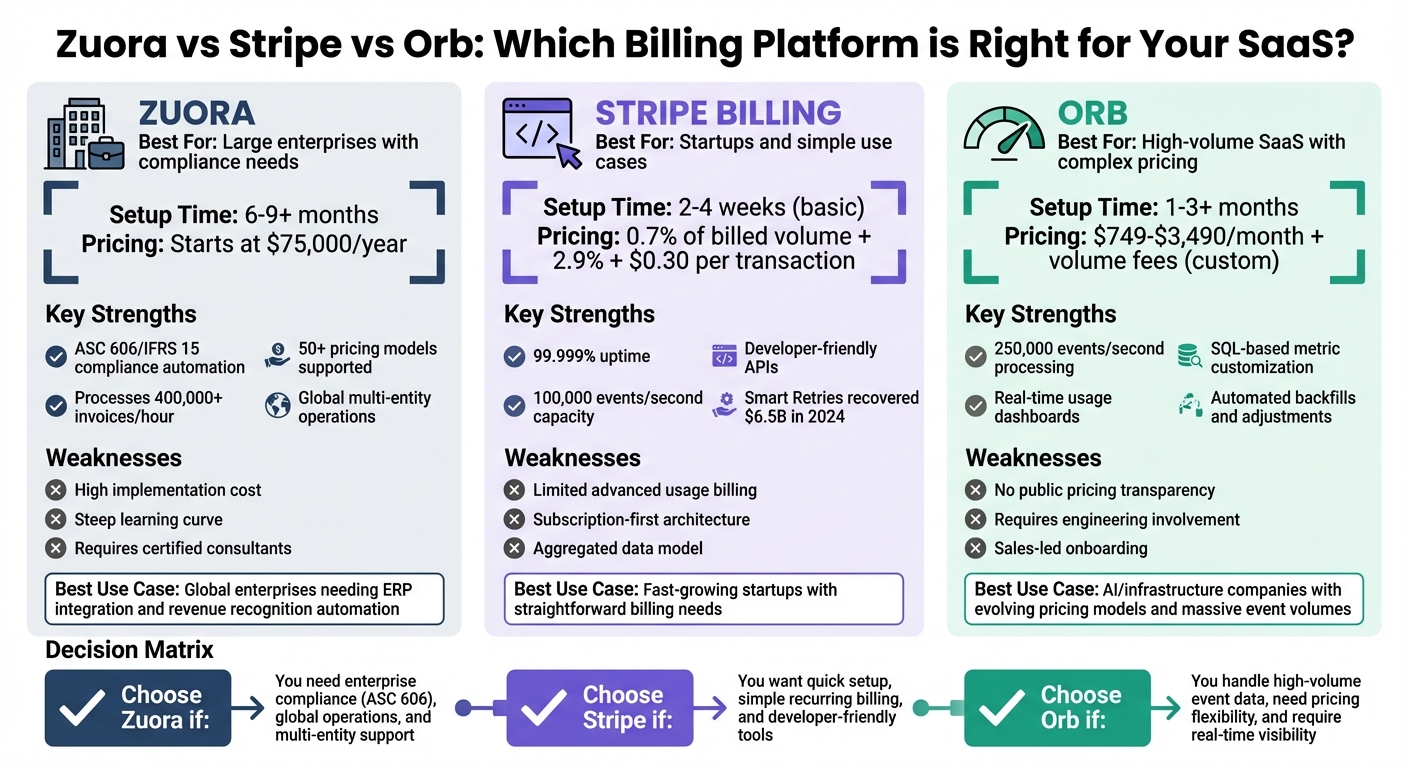

Choosing the right billing platform for complex SaaS pricing models can be challenging. Here's a quick breakdown:

- Zuora: Best for large enterprises needing compliance (e.g., ASC 606) and global operations. Handles complex billing but requires longer setup and higher costs.

- Stripe: Ideal for startups and simpler use cases with strong developer tools and quick setup. Limited for advanced usage-based billing.

- Orb: Built for SaaS companies handling high-volume, real-time usage data and evolving pricing models. Offers flexibility but lacks public pricing and requires more engineering for setup.

Quick Comparison

| Feature | Zuora | Stripe Billing | Orb |

|---|---|---|---|

| Best For | Enterprises with compliance needs | Startups, simple use cases | High-volume SaaS with complex pricing |

| Setup Time | 6–9+ months | 2–4 weeks (basic) | 1–3+ months |

| Pricing | Starts at $75,000/year | 0.7% of billed volume | Custom (contact sales) |

| Strengths | Compliance, global scalability | Developer-friendly, quick | Real-time usage, SQL-based models |

| Weaknesses | High cost, complex setup | Limited for advanced billing | No public pricing, longer setup |

Key Takeaway:

Choose Zuora for enterprise compliance, Stripe for simplicity, or Orb for high-volume, usage-heavy SaaS.

Zuora vs Stripe vs Orb: Usage-Based Billing Platform Comparison for SaaS

Subscription vs. Usage-Based Pricing: Which Scales Better?

Zuora: Enterprise Billing for Complex Requirements

Zuora is a billing platform designed for enterprises, offering a seamless integration of order-to-cash processes - from usage event tracking to financial reporting. By combining quoting, billing, payments, and revenue recognition into one system, it becomes an ideal choice for SaaS companies managing large transaction volumes and strict compliance standards.

One of Zuora's standout features is its ability to handle massive amounts of data through its mediation and rating engines, which can process billions of usage events daily. A great example of this is Zoom, which adopted Zuora in 2015 before its Series C funding. With Zuora, Zoom scaled its user base from 10 million to 300 million in under six months, all while managing a rapidly growing business worth billions. Similarly, Box used Zuora to experiment with over 125 new offerings and numerous pricing strategies, growing its revenue from $3 million to more than $500 million - all without needing to overhaul its billing system.

What Zuora Does Well: Flexibility and Compliance

Zuora shines in managing complex billing needs. It supports more than 50 pricing models, including pay-as-you-go, prepaid credits with drawdowns, tiered pricing, volume-based discounts, and multi-attribute pricing that takes into account factors like time, usage, and customer tier.

One of its key strengths is its ASC 606 compliance automation, which simplifies revenue tracking. The platform automatically monitors earned and deferred revenue as customers use prepaid balances at varying rates. For instance, Riverbed Technology saw a dramatic reduction in its Standalone Selling Price (SSP) analysis time - by over 90% - and shortened its monthly book-closing process to just 4–5 days after implementing Zuora Revenue. Mark Million, Director of Revenue Accounting at Riverbed Technology, shared:

"Zuora Revenue has streamlined and standardized our revenue recognition process to the point where we can now close our books accurately in just 4-5 days and reduce SSP analysis time by more than 90%!"

Zuora also provides real-time rating and threshold notifications, which give billing teams and customers mid-cycle insights into usage and costs. This feature helps avoid surprise charges and minimizes disputes. Impressively, the platform processes over 400,000 invoices per hour, cutting bill run times by 40% to 95%.

Where Zuora Falls Short: Complexity and Cost

Zuora's enterprise-level capabilities come with their own set of challenges, particularly in terms of implementation complexity. Transitioning to usage-based billing models on Zuora often demands significant coordination between finance, product, and engineering teams. Hudl, a global sports analytics company, managed to save over 100 hours per month by automating its quote-to-cash process with Zuora, but only after navigating a resource-intensive implementation process.

Another drawback is the lack of public pricing. Zuora positions itself as a high-end enterprise solution, with costs that scale based on a company's specific needs and the edition chosen. For businesses relying on in-house systems, the cost of noncompliance can average $14 million. Smaller SaaS companies or those with simpler billing requirements may find the platform's total cost of ownership - including implementation, training, and maintenance - too steep.

Additionally, Zuora’s depth means there’s a steep learning curve. While the platform offers over 40 pre-built payment gateway connectors and extensive support for global expansion, teams often require months of onboarding and training to fully utilize its features. As Lauren Feeney, Financial Controller at Secureframe, puts it:

"It's reassuring to know that with Zuora we can continue to scale our business to meet the needs of our growing global customer base."

However, this confidence usually comes after a lengthy setup process. These challenges highlight the importance of weighing Zuora's features and costs against other platforms before making a decision.

Stripe Billing: Developer-First Platform with Strong APIs

Stripe Billing is built with developers in mind, following a four-stage API-driven process: Ingestion (sending usage data), Product Catalog Setup (creating pricing structures), Billing (managing customer subscriptions), and Monitoring (setting threshold alerts). This setup makes it easier for SaaS companies to implement usage-based billing, especially when dealing with hybrid models that combine fixed and variable charges.

With its Meters API, Stripe simplifies tracking by recording raw events like API calls, compute time, or storage usage and automatically converting them into billable totals. This means developers don’t have to write custom logic to calculate usage within their applications. Stripe handles massive scale, processing over 100,000 usage events per second per business and supporting up to 100 million usage events per month in its standard plan. OpenAI praised this capability, stating:

"We chose Stripe because of the range of pricing model options, their ability to move fast, and their high bar for excellence. Usage-based pricing can be complex, but Stripe makes our systems much simpler."

For businesses with hybrid billing needs, Stripe’s Pricing Plans allow bundling of fixed fees, metered rates, and recurring credits into one package. The platform also separates the "service interval" (how often usage is aggregated, such as weekly) from the "billing interval" (when invoices are issued, such as monthly). This gives companies flexibility in managing cash flow while reducing administrative overhead - ideal for SaaS companies that frequently track usage but prefer less frequent invoicing.

What Stripe Does Well: Real-Time Processing and Global Payments

Stripe’s real-time metering is a standout feature for businesses requiring immediate insights into usage. It supports real-time credit burndown for prepaid models, showing customers their remaining balance as they consume services. This transparency helps reduce billing surprises, a common issue that can lead to customer dissatisfaction and churn.

Stripe’s global payment capabilities are equally impressive. It supports a wide range of payment methods, including credit cards, digital wallets (Apple Pay, Google Pay), and localized options like iDEAL and ACH, across more than 100 countries. With a historical uptime of 99.999%, Stripe ensures reliability, while its Smart Retries feature recovers 57% of failed recurring payments. In 2024 alone, Stripe’s recovery tools helped users reclaim over $6.5 billion in revenue.

Another strength is its multi-dimensional metering, which allows developers to define specific attributes - like customer tiers or API call types - for more granular pricing models. For instance, a SaaS company could charge varying rates based on both the type of API call and the customer’s subscription level, all tracked seamlessly through one meter. The Entitlements API further simplifies this by managing feature access based on a customer’s subscription and usage, eliminating the need for custom-built permission systems.

Midjourney leveraged these features to scale efficiently, with a representative noting:

"Stripe's support for usage-based billing helped us build trust with customers, reduce AR time, and reach profitability early on without adding headcount."

The fact that 78% of the Forbes AI 50 companies rely on Stripe for their financial infrastructure highlights its reliability for high-growth, usage-heavy businesses.

However, Stripe does face challenges in certain invoicing scenarios.

Where Stripe Falls Short: Invoicing Without Payments

Stripe’s biggest limitation lies in its tightly integrated billing and payment processing. As a "subscription-first" platform that later added usage-based features, it works well for SaaS companies with simple usage add-ons. But businesses needing invoicing workflows separate from payment collection may find it less flexible.

For example, enterprise sales often involve invoices with net-30 or net-60 payment terms, where payments are not immediately collected. Stripe’s hosted invoices and payment links assume Stripe will handle the payment process. Companies using external payment processors or issuing invoices purely for record-keeping may struggle to adapt Stripe’s tools to their needs.

While Stripe’s revenue recognition is strong for delivery-based models (recognizing revenue as services are consumed), implementing it requires a delivery-specific approach with accruals, reversals, and rebookings. This can complicate audits against transaction records. Additionally, advanced usage-based "billable items" are not fully supported in all standard Stripe reports, which might force developers to rely on custom reporting via Stripe Sigma.

Another limitation is Stripe’s lack of support for last or max aggregation types in its private preview. Businesses needing to bill based on peak usage or the most recent value within a billing period will need to find workarounds or alternative solutions.

Next, we’ll dive into how different platforms stack up in terms of billing models, scalability, and overall performance.

Orb: Built Specifically for Usage-Based SaaS

Orb is purpose-built to handle the complexities of hybrid subscription and usage-based billing. Unlike platforms that rely on aggregated data, Orb processes every event in real time, enabling features like automated backfills and retroactive invoice adjustments when delayed data comes in. This real-time approach ensures smooth integration of hybrid billing functionalities.

The platform supports a variety of billing models, including seat-based subscriptions, usage overages, tiered pricing, and volume discounts. Thanks to its SQL-based metrics, teams can modify billing parameters without needing to overhaul the entire system. This adaptability is especially beneficial for industries like AI and infrastructure, where pricing models evolve rapidly.

Francesca LaBianca, VP of Operations, highlighted Orb's value:

"Orb lets us move quickly when pricing needs to evolve as AI models and agent capabilities advance. It gives us the flexibility to stay ahead of the market, without compromising on transparency for our customers."

Orb handles over 1 million billing events per second, includes a revenue simulation engine for testing pricing strategies, and offers real-time threshold invoicing to help prevent unexpected charges.

What Orb Does Well: Granular Usage Control and Plan Versioning

Orb's architecture shines when it comes to precision billing. Its diff-based billing engine compares the expected state of a subscription to its actual state, making it possible to handle backdated changes, mid-period cancellations with refunds, and retroactive pricing adjustments. Each subscription is managed as a timeline of versioned pricing objects, allowing businesses to seamlessly transition customers to new plans or schedule future updates without disrupting billing cycles.

The platform also supports dimensional pricing, enabling charges based on multiple event attributes, such as region, for more tailored billing. By retaining raw event data, Orb creates detailed, itemized invoices that go beyond what aggregated systems can provide. For added transparency, the platform includes an "Experience Kit" that powers real-time dashboards, allowing end-users to monitor their usage and spending. Additionally, automated backfills recalculate invoices when late data or mid-cycle pricing updates occur, removing the need for manual corrections.

Where Orb Falls Short: No Public Pricing

One of Orb's main drawbacks is its lack of publicly available pricing. To get a quote, companies must contact the sales team, making it harder to evaluate costs during the initial decision-making process. While the pricing model typically includes a platform fee along with volume-based tiers or a percentage of revenue, the absence of upfront transparency can be a hurdle.

Another limitation is Orb's sales-led onboarding, which can feel cumbersome compared to platforms that allow for easier self-service. Implementation often requires significant developer involvement. For SaaS companies with straightforward billing needs, Orb might not be the most economical choice. Additionally, as a newer player in the market compared to established names like Stripe or Zuora, some businesses may hesitate due to the lack of predefined pricing tiers or a clear cost structure. However, for companies with intricate metering requirements - such as those in AI, infrastructure, or data management - Orb's specialized features often make its custom pricing worthwhile.

Next, we’ll dive into a comparison of how these platforms measure up across key features and billing model support.

sbb-itb-0499eb9

Zuora vs. Stripe vs. Orb: Feature Comparison

How Each Platform Handles Billing Models

When it comes to managing hybrid billing models, understanding how each platform approaches billing is key. Stripe and Zuora lean heavily on subscription-first frameworks, while Orb takes a usage-first approach, processing raw event-level data. Stripe works with aggregated or periodic usage summaries, whereas Orb handles raw, detailed event data at speeds of up to 250,000 events per second. Zuora, on the other hand, processes data in batches, which works well for traditional subscription setups but struggles with real-time usage demands.

Orb is designed to natively support hybrid models by combining seats and usage into a single subscription. Stripe, however, employs "Pricing Plans", which mix fixed fees with rate cards for metered usage, allowing up to 500 different rates. Zuora also supports hybrid billing, though it often requires more extensive configuration.

One standout feature of Orb is its ability to adjust billable metrics using SQL-based logic, eliminating the need for code changes. Stripe, in contrast, requires additional engineering effort for such customizations. Alvaro Morales, CEO of Orb, highlighted this difference:

"Stripe is a subscription billing platform that added limited usage-based features - Orb is a full-stack, usage-based billing solution built for pricing agility".

These distinctions highlight how each platform caters to different billing needs, especially when operating at scale.

| Feature | Stripe Billing | Orb | Zuora |

|---|---|---|---|

| Primary Architecture | Subscription-first | Usage-first (Event-driven) | Subscription-first |

| Data Model | Aggregated/Predefined | Raw event-level data | Batch processing |

| Hybrid Support | Pricing Plans (license + rate card) | Native support for seats + usage | Configurable; recurring charges |

| Metering Flexibility | Limited – needs engineering | High; SQL-based customizations | Enterprise-level complexity |

| Real-time Visibility | Periodic summaries | Real-time dashboards and alerts | Batch-based reporting |

Scalability and Performance Differences

Orb stands out when it comes to handling high-volume scenarios. Its infrastructure is built to process up to 250,000 events per second and scale to millions of events as demand grows. Companies like Perplexity and Vercel rely on Orb to manage large volumes of API calls, AI token usage, and infrastructure data in real time. This capability is crucial for SaaS companies that operate at scale and need reliable, high-speed billing.

Stripe, however, may face challenges due to its reliance on aggregated data and API rate limits. For instance, Stripe Billing charges 0.7% of billed volume, which could translate to $70,000 annually for a company with $10 million in usage charges. Alvaro Morales pointed out:

"Stripe was not originally purpose-built for usage-based billing, and that's why it falls short... its low rate limits can't handle large event volumes effectively".

Zuora, while strong in managing enterprise-level complexities like multi-entity operations and global financial consolidation, is less equipped for real-time, high-velocity billing. Its batch processing and limited native usage metering make it less ideal for fast-moving scenarios. Additionally, Zuora implementations typically take longer - often exceeding Orb's 2 to 6 weeks or Stripe's quick, developer-friendly setup.

This performance gap is significant, especially when you consider that billing system failures can contribute to 20% to 40% of all SaaS churn due to involuntary cancellations.

Pricing and Implementation: Total Cost of Ownership

How Each Platform Charges and Cost Efficiency

When it comes to hybrid subscription and usage-based billing, keeping costs manageable and ensuring a smooth setup are top priorities.

Zuora starts its pricing at an annual fee of $50,000 to $75,000 for its "Launch" tier. The "Scale" and "Enterprise" tiers can climb to $175,000 and $250,000+ per year, respectively. On top of that, there are extra costs for professional services and overage fees. Even basic features, like single sign-on (SSO) or Salesforce CPQ integration, often require upgrading to a higher plan, which can significantly raise the yearly expense.

Stripe Billing, on the other hand, charges 0.7% of billed volume. For a business generating $10 million annually, that’s about $70,000 in fees, not counting payment processing costs. Stripe also offers monthly plans, starting at $620/month for up to $100,000 in volume, $1,500/month for up to $250,000, and $5,750/month for up to $1 million. A 0.67% fee applies to any volume beyond these limits. While Stripe’s pricing is appealing for smaller businesses, it can become less cost-effective as your revenue grows.

Orb takes a middle-ground approach with subscription tiers ranging from $749 to $3,490 per month, plus additional charges tied to invoice value and event volume. Designed with high-volume raw event ingestion in mind, Orb’s structure is better suited for businesses with complex metering needs, compared to platforms retrofitted for such tasks. Interestingly, companies using usage-based models, like those supported by Orb, report 28% higher net retention compared to businesses relying on fixed subscriptions.

Setup Time and Learning Curve

The time and effort required to implement each platform can vary widely.

Stripe offers one of the fastest setups, typically taking 2–4 weeks for simpler models, though complex B2B setups might extend to 3 months. Its developer-friendly approach minimizes the need for specialized labor, making it a good choice for straightforward billing needs.

Orb implementations, however, take longer - between 1 and 3+ months - and involve significant engineering work. This includes integrating data pipelines and defining metrics through SQL. That said, companies like Stytch have seen major time savings after adopting Orb, cutting 75% of the time previously spent on billing and invoicing tasks.

Zuora, on the other hand, has the longest implementation timeline, often stretching 6–9+ months. It typically requires certified consultants or dedicated internal teams to handle the setup. For instance, Hudl used Zuora to automate its quote-to-cash process, saving over 100 hours per month for its finance team. However, the platform’s complexity often leads to lengthy projects, especially for enterprise-scale billing needs that demand extensive consulting.

For scaling SaaS companies, the stakes are high. The average cost of financial noncompliance can hit $14 million, making the choice of a billing platform a critical decision that goes far beyond just the upfront implementation costs. Understanding these differences in pricing and setup times is essential for selecting the right platform for your business.

Which Platform Fits Your SaaS Business?

Summary of Each Platform's Strengths and Trade-Offs

Stripe is ideal for early-stage startups with straightforward billing needs. If your business uses Stripe for payments and manages basic usage add-ons, it offers a quick and accessible solution. Its developer-friendly, pay-as-you-go pricing - 2.9% + $0.30 per transaction, plus 0.7% of billing volume - keeps operations simple and efficient. However, Stripe's focus on subscription-based billing means it may fall short for businesses with more advanced usage billing requirements.

Orb is designed specifically for SaaS companies dealing with high data volumes and complex pricing models. With infrastructure capable of processing up to 250,000 events per second and SQL-based metrics, it empowers finance teams to tweak pricing without needing engineering support. Orb shines when supporting hybrid billing models that combine seat-based and usage-based pricing within a single subscription. Pricing details are available upon request.

Zuora caters to large, global enterprises with intricate compliance and operational demands. It automates revenue recognition in line with ASC 606 and IFRS 15 standards and handles multi-entity operations seamlessly. Sid Sanghvi, Head of FinTech, highlighted its flexibility:

"Zuora Platform gives us that flexibility to innovate on pricing, launch new offerings, and align finance and product".

However, Zuora comes with significant costs, starting at around $75,000 annually, and often requires professional services to manage its steep learning curve. These insights provide a foundation for weighing your options when selecting the most suitable platform.

How to Choose the Right Platform

As hybrid subscription and usage-based pricing models grow more complex, the right billing platform should balance operational efficiency with scalability. Based on the comparisons above, your choice should depend on your business's stage, data volume, and pricing intricacies.

- Pick Stripe for a fast setup and straightforward recurring billing needs.

- Pick Orb if you handle large-scale event data, need frequent pricing updates, or require real-time usage visibility.

- Pick Zuora if you're a global enterprise requiring deep integration with ERP systems like NetSuite and compliance with complex accounting standards.

Billing platforms are increasingly moving toward "usage-first" architectures that process raw event data instead of relying on pre-aggregated totals. Assess whether your chosen platform can support this trend without demanding constant engineering adjustments or costly migrations.

FAQs

How do I choose the best platform - Zuora, Stripe, or Orb - for complex SaaS billing with hybrid subscription and usage models?

When weighing options like Zuora, Stripe, and Orb for SaaS billing - especially if you’re dealing with hybrid subscription and usage-based models - it’s important to focus on a few key aspects:

- Handling complex pricing structures: Orb stands out for businesses with heavy usage-based models, offering advanced tools like real-time pricing experiments and multi-dimensional tiers. Stripe works well for simpler setups but might fall short for more intricate hybrid models. Zuora does support hybrid pricing but often requires significant customization and effort to implement effectively.

- Real-time usage and scalability: If your business needs real-time data processing and granular event billing, Orb is a strong choice. Stripe, on the other hand, processes usage in batches, which could be a limitation for high-frequency billing scenarios. Zuora can manage usage billing but might face challenges with extremely high volumes.

- Integration and cost considerations: Stripe is a natural fit if you’re already using its payment stack, offering seamless integration. Orb focuses on automating finance workflows, making it appealing for businesses prioritizing efficiency. Zuora provides a wide range of integration options but often comes with higher implementation costs.

Ultimately, the right choice depends on your specific billing complexity, scalability needs, and budget. Carefully assess how each platform aligns with your SaaS business requirements.

How do Zuora, Stripe, and Orb ensure compliance and support global scalability for SaaS companies?

Each platform takes a unique approach to meeting compliance requirements and supporting global growth, tailored to different SaaS business needs.

Orb is built for handling high-volume, usage-intensive workloads. It places a strong focus on compliance with ASC 606 revenue recognition standards, ensuring security and scalability for SaaS companies managing intricate billing structures.

Stripe leans on its robust global payments infrastructure, offering features like automated tax calculations, fraud detection, and international payouts. These tools make it an appealing choice for SaaS businesses looking to expand across borders while adhering to local regulations.

Zuora delivers a wide range of billing and payment modules, though it doesn't provide detailed public documentation on compliance standards like ASC 606 or PCI. Its primary focus is on supporting both subscription and consumption-based models, offering flexibility for diverse business needs.

Orb emphasizes real-time usage billing with a strong compliance and scalability focus, Stripe shines in global payment automation, and Zuora provides versatility, albeit with less clarity on specific compliance standards.

What are the costs and setup times for using Zuora, Stripe, and Orb for SaaS billing?

Pricing and implementation timelines for Zuora, Stripe, and Orb aren't openly shared, which means pinning down exact numbers can be tricky. Each of these platforms brings its own set of features to the table for SaaS billing, but their costs and onboarding times often hinge on factors like your business's specific needs, usage patterns, and the terms of your contract.

To get precise pricing and setup details, your best bet is to reach out directly to the sales or support teams of these platforms. This way, you’ll receive the most current and customized information tailored to your SaaS business.

Go deeper than any blog post.

The full system behind these articles—frameworks, diagnostics, and playbooks delivered to your inbox.

No spam. Unsubscribe anytime.